Stock Market LIVE: Sensex jumps 300 pts, Nifty 100; Auto, FMCG shine; IT drags

[ad_1]

A pessimistic mood has taken a grip on investors as central bankers seem ready to push the market into recession and keep fighting inflation as their main task. Inflation has been easing but remains painfully high. That has prompted the central bankers to maintain their aggressive attack.

Hospitality industry set for buoyant 2023

The domestic hospitality industry is looking to ‘fly’ in 2023 cashing in on India’s G20 presidency, having received the ‘oxygen’ to run in 2022 after being crippled in the past two years by the pandemic.

Domestic travel, especially the leisure segment, gave wind to the industry this year and is expected to continue into the next. Industry players believe that as international arrivals are also likely to pick up even further, the outlook for 2023 is buoyant.

However, for travellers, room tariffs are likely to remain high going forward, with a demand-supply mismatch continuing in the hospitality sector.

“I think it’s really safe to say that we have overcome the real difficult period. I don’t think any one of us can deny that it was really difficult, in all terms — occupancies, daily average rates and revenue per available room (during the pandemic),” Hotel Association of India Vice President KB Kachru told PTI. (PTI)

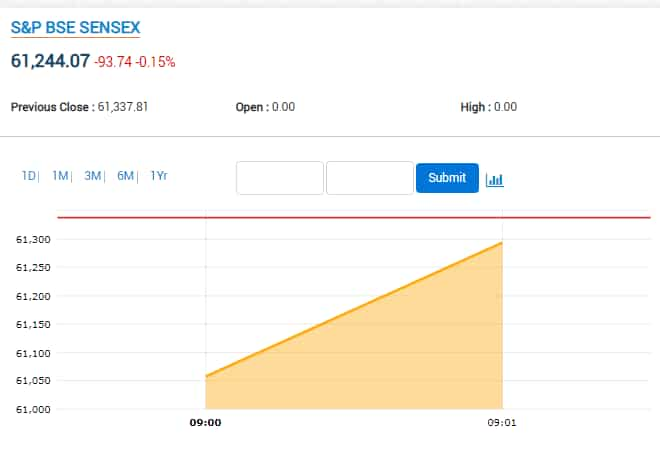

Noon Update: Indices trade in green as Sensex is up 300 pts and Nifty 100 pts. FMCG and Auto remain strong while IT index drags

View Full Image

L&T to sell its entire 51% stake in L&T IDPL to Epic Concesiones

Larsen & Toubro on 19 December said that it signed an agreement to divest its 51 percent stake in L&T Infrastructure Development Projects Limited (L&T IDPL) to Epic Concesiones Private Limited. Epic Concesiones is a portfolio company of Infrastructure Yield Plus II, an infrastructure fund managed by Edelweiss Alternatives. (Read More)

Manish Goel multibagger stock turns ₹1 lakh to ₹4 crore in 10 years

This multibagger stock has surged over 400 times in last 10 years as the stock has gone through subdivision in 1:5 ratio in this period as well. Swiss Glascoat now HEL Glasscoat share price was around ₹8.25 apiece around 10 tears ago. This multibagger Manish Goel stock has risen from this level to the tune of ₹666 apiece today. However, there is a catch in HEL Glasscoat share price history. This multibagger stock has gone through stock split in October 2022. So, if an investor had invested in this Manish Goel stock 10 years ago, its net shareholding in the company would have surged to 5 times without any investment. (Read More)

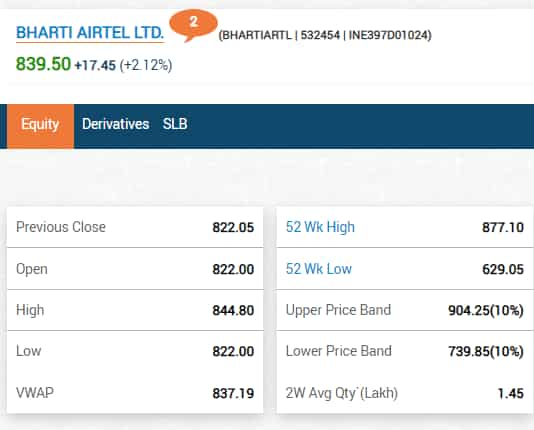

Bharti Airtel is among the biggest gainers as it climbs 2% in today’s trade

View Full Image

Musk launches poll on whether he should quit as Twitter CEO

Twitter CEO Musk launched a poll on the social media platform on Sunday asking whether he should step down as head of the company, adding that he would abide by the poll results.

The poll is scheduled to close around 1120GMT on Monday although the billionaire did not give details on when he would step down if the poll results said he should.

Replying to one Twitter user’s comment on a possible change in CEO, Musk said “There is no successor”.

Musk told a Delaware court last month that he would reduce his time at Twitter and eventually find a new leader to run the company. (Reuters)

Yes Bank share price jumps after sale of NPA to JC Flowers. Buy, sell or hold?

Yes Bank shares jump by over 4 per cent in early morning deals on Monday session. Yes Bank share price today opened with an upside gap and went on to hit an intraday high of ₹22.10 apiece on NSE, logging around a 4.25 per cent rise in the stock market’s opening bell today.

According to stock market experts, Yes Bank shares are rising today due to the new break about the private lender concluding the sale of NPA to JC Flowers Asset Reconstruction Private Limited, which is expected to pull down Yes Bank’s GNPA below 2 per cent and net NPA below 1 per cent. (Read More)

China stocks fall as COVID outbreaks dent sentiment

China stocks fell on Monday, as concerns over surging COVID-19 cases disrupting economic activity outweighed support from government bodies.

** The blue-chip CSI 300 Index was down 1% by the end of the morning session, while the Shanghai Composite Index declined 1.3%.

** Hong Kong’s Hang Seng Index dropped 0.5%, and the Hang Seng China Enterprises Index lost 0.3%.

** China is in the first of an expected three waves of COVID cases this winter, according to the country’s chief epidemiologist, Wu Zunyou. Further waves will come as people follow the tradition of returning en masse to their home areas for the Lunar New Year holiday next month, he said. (Reuters)

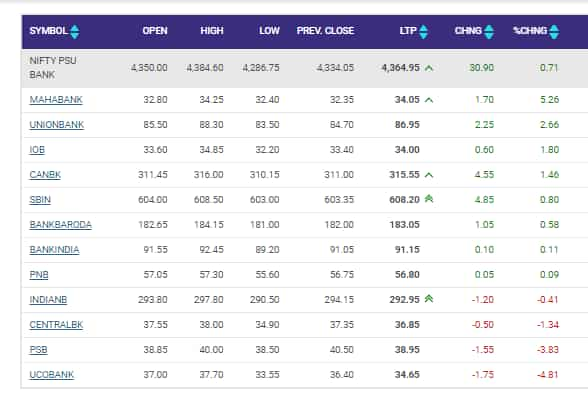

PSU Bank index experiences volatility but has settled in green with most stocks gaining

View Full Image

Is all well for Indian IT companies after Accenture warning? And their stocks?

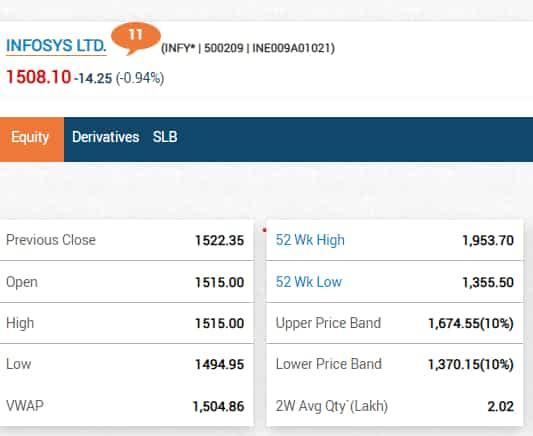

Indian IT stocks were weak today after global giant Accenture Plc on Friday warned about a possible pullback in client spending. Nifty IT index was down 0.33%, extending this year’s losses to 26%. Infosys, TCS and Wipro were down between 0.3% and 1% in early trade as compared to a 0.2% rise in Sensex. On Friday, Accenture shares had cracked 6% in overseas markets.

After a pandemic-led boom, spending on IT and transformation projects is slowing as companies prioritize projects that deliver stronger return-on-investments in an uncertain economy. (Read More)

Rupee slips 2 paise to 82.77 against US dollar

The rupee depreciated 2 paise to 82.77 against the US dollar in early trade on Monday weighed down by foreign capital outflows and a rise in crude oil prices in the international market.

However, a weak greenback against major rivals overseas cushioned the downside for the local unit, forex dealers said.

At the interbank foreign exchange, the domestic unit opened weak at 82.80 against the dollar, then gained some ground to quote 82.77, registering a decline of just 2 paise over its previous close.

In the previous session on Friday, the rupee settled almost flat at 82.75 against the US dollar.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.15 per cent to 104.54. (PTI)

Infosys remains under pressure in today’s session, sheds around a per cent

View Full Image

Glenmark gets US FDA nod for high BP capsules

Glenmark Pharmaceuticals Limited has received final approval by the United States Food and Drug Administration (US FDA) for Nicardipine Hydrochloride Capsules, 20 mg and 30 mg, the generic version of Cardene Capsules, 20 mg and 30 mg, of Chiesi USA, Inc.

In an official statement, the company said that Glenmark’s Nicardipine Hydrochloride Capsules, 20 mg and 30 mg, will be distributed in the US by Glenmark Pharmaceuticals Inc., USA. (Read More)

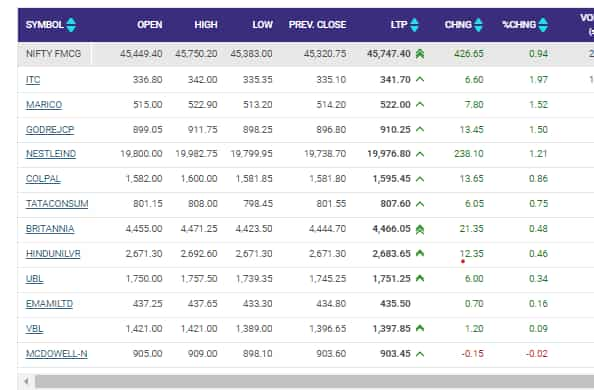

FMCG index shines amidst a flat day with almost all stocks trading in the green

View Full Image

Elin Electronics IPO: What GMP signals as public issue opens soon

The initial public offering (IPO) of Elin Electronics Ltd is going to open for subscribers on 20th December 2022 and it will remain open for bidders till 22nd December 2022. The public issue worth ₹475 crore aims to raise ₹175 crore from fresh issue whereas ₹300 crore of the net proceeds has been kept reserved for OFS (offer for sale) route.

As the public issue is going to hit primary markets on Tuesday this week, shares of the company have become available in grey market. According to market observers, Elin Electronics shares are available at a premium of ₹47 in grey market today. (Read More)

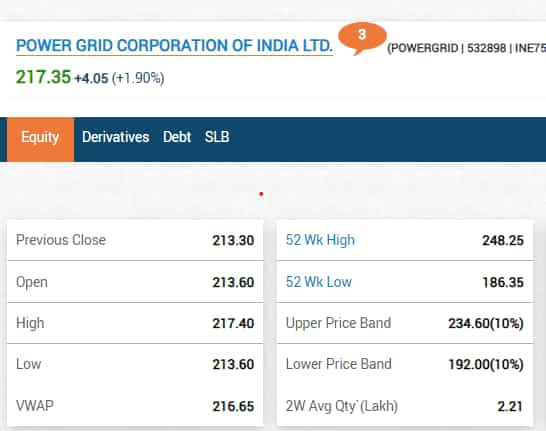

Powergrid jumps in the initial trading, gains 2%

View Full Image

INDIA BONDS-Bond yields seen steady on lack of fresh triggers, oil prices eyed

Indian government bonds are expected to open steady on Monday as traders will track movement in oil prices and U.S. Treasury yields, without fresh triggers.

The benchmark 10-year yield is likely to move in a 7.25%-7.30% band during the day, a trader with a private bank said. The yield ended higher at 7.2768% on Friday.

“There were a lot of global as well as domestic events in the first two weeks of December, and no fresh trigger is lined up, so the market will largely remain rangebound,” they said.

As is usually the case towards the end of a calendar year and a quarter, activity and volume will remain low as traders assess their positions, said another trader.

Oil prices fell on Friday but were up again on Monday morning, so traders will closely track the movement before taking any large positions, said a dealer with a state-run bank. (Reuters)

Indices open flat with IT stocks dragging amidst mostly negative global cues

View Full Image

Geojit Financial Services on today’s market: Market trends are likely to oscillate like the World Cup finals

Dr V K Vijayakumar, chief investment strategist at Geojit Financial Services: The synchronised rate hikes by the leading central banks of the world and their hawkish tone impacted market sentiments last week with Nifty closing below the near-term support of 18400. While this risk-off can continue to impact the market, there are positive triggers too, like steadily declining inflation in the U.S. and the hope that the Fed will respond to this with a pause in rate hikes in early 2023. Therefore, market trends are likely to oscillate like the World Cup finals. Leading indicators point to a resilient Indian economy. Credit growth continues to be strong and this can impart strength to the Bank Index. High-quality bank stocks can be bought on declines. IT may show weakness on fears of a US recession but this weakness can be an opportunity for long-term investors. The capital goods segment is on a strong wicket.

17 cars from Maruti Suzuki, Tata & others may be discontinued in 2023: Here’s why

The upcoming 2023 year so far does not hold good news for car buyers in the country. Leading car companies have announced price hikes across models from January 2023. Now, reports suggest that 17 cars offered by different auto manufacturers may be discontinued from April 2023. Why? Because a new set of emission regulations called the Real Driving Emission (RDE) norms will be set in from April next year in the country.

This will require car makers to upgrade their car engines which may be more expensive than the existing ones. Most affected by these new emission norms will be diesel cars. As per reports, companies are also looking to discontinue some models to comply with the new rules. Wondering which cars could be taken off the road?

Here’s a list of cars that may not run on roads from April 2023

Sensex preopens in the flat territory with L&T, UPL, Tata Motors and JSW Energy being in focus

View Full Image

Bank of Maharashtra appoints Prashant Kumar Goyal as Director

The Bank of Maharashtra on Friday said it appointed Prashant Kumar Goyal as Director of the lender with effect from Thursday.

According to a statement from the lender, Prashant Kumar Goyal is a 2007 batch IAS officer of the Tripura cadre, who was on central deputation and working as a director in the Department of Financial Services.

He was earlier posted as secretary to the chief minister of Tripura, with an additional charge of secretary, general administration (Cabinet and Confidential) Department with independent charge of industries and commerce department and information and cultural affairs department. (ANI)

Reliance Securities Stock in Focus Today: Prince Pipes And Fittings

STOCK IN FOCUS

Prince Pipes And Fittings (CMP 628): We expect Prince to expand its leadership with manufacturing expertise, leveraged distribution and competitive agility in the pipes sector. In view of the expected pick-up in demand, cost optimization measures and series of strategies for the next level of growth, we have our BUY rating on the stock with Target Price at ₹700.

Intraday Picks

BERGEPAINT (PREVIOUS CLOSE: 595) BUY

For today’s trade, long position can be initiated in the range of ₹588-

592 for the target of Rs.610 with a strict stop loss of ₹584.

ICICIPRULI (PREVIOUS CLOSE: 444) BUY

For today’s trade, long position can be initiated in the range of ₹436-

440 for the target of Rs.455 with a strict stop loss of ₹432.

SBIN (PREVIOUS CLOSE: 603) SELL

For today’s trade, short position can be initiated in the range of ₹608-

612 for the target of Rs.588 with a strict stop loss of ₹618.

Mukesh Ambani to take on ITC, Patanjali, Tata, Adani with FMCG brand ‘Independence’

Billionaire Mukesh Ambani-led Reliance will rival FMCG food businesses of ITC, Tata Consumer Products Ltd and Adani Wilmar with the launch of the brand ‘Independence’ for staples, processed foods, beverages and other daily essentials, analysts said.

Reliance Consumer Products Ltd (RCPL), the newly set up FMCG arm of Reliance Retail Ventures Ltd (RRVL) last week made a foray into staples with the launch of brand Independence in line with an announcement Ambani had made at the company’s annual shareholder meeting earlier this year. (Read More)

Stocks to Watch: L&T, UPL, JSW Energy, Tata Motors, Sun Pharma, PTC India, Tech Mahindra, Ashoka Buildcon, Dr Reddy’s Laboratories, and Bank of Maharashtra

NSE has listed Balrampur Chini, Delta Corp, Bhel, Indiabulls Housing Finance, Gujarat Narmada Valley Fertilizers & Chemicals, IRCTC, and PNB on the list of banned securities under the F&O segment for Monday trading as they have crossed 95% of the market-wide position limit. (Read More)

Tata Motors subsidiary signs deal with BMTC to supply 921 electric buses

Automobile major Tata Motors on Friday announced that Bengaluru Metropolitan Transport Corporation (BMTC) has signed an agreement with its subsidiary company for the operation of 921 low-floor electric buses in the city. As part of the agreement, subsidiary firm TML Smart City Mobility Solutions will supply, operate and maintain 921 units of electric buses for 12 years, Tata Motors said in a statement. It further said that Tata Starbus Electric is an indigenously-developed 12-metre-long vehicle with superior design and best-in-class features for a sustainable and comfortable commute. It further said that Tata Motors has to date supplied more than 730 electric buses across multiple cities in India, which have cumulatively clocked more than 55 million kilometres. (PTI)

Buy or sell stock: Vaishali Parekh recommends 2 shares to buy today

Vaishali Parekh of Prabhudas Lilladher has recommended two stocks to buy today, here we list out full details in regard to those two shares:

1] Mahindra CIE Automotive: Buy at ₹326, target ₹400, stop loss ₹290; and

2] NALCO: Buy at ₹77.35, target ₹89, stop loss ₹73. (Read More)

Sun Pharma gets warning letter from USFDA for Halol plant

Drug major Sun Pharma on Friday said it has received a warning letter from the US health regulator for its Halol facility which is already under an import alert.

The warning letter summarises violations with respect to Current Good Manufacturing Practice (cGMP) regulations, the Mumbai-based company said in a regulatory filing.

The US Food and Drug Administration shall make public the contents of the Warning Letter in due course, it added.

On December 8, Sun Pharma had announced that its Halol facility in Gujarat has been listed under import alert by the USFDA with products manufactured at the unit now are subject to refusal of admission in the US market. (PTI)

‘Odds of succeeding when actively trading are very low’: Nithin Kamath

Zerodha co-founder Nithin Kamath’s statement about the dismal performance of individual investors in derivatives trading highlighted the risk involved in equity futures and options. According to Kamath, just 1% of his firm’s customers who actively trade equity derivatives generated annual returns higher than bank deposits over the past three years.

“We have used every opportunity to create awareness that in the long run (3-year period), less than 1% of those who actively trade equity futures and options generate returns higher than bank fixed deposits or 7% annually,” Kamath said in a business update on Zerodha, the country’s largest stockbroker, over the weekend. (Read More)

Oil advances on China’s growth pledge and US move to refill SPR

Oil edged higher at the week’s open on bullishness from the Biden administration’s plan to begin refilling its strategic crude reserves and a pledge from China to revive consumption as Covid Zero is abandoned.

West Texas Intermediate rose toward $75 a barrel after dropping almost 4% in the final two sessions of last week. The US is starting to replenish the Strategic Petroleum Reserve, starting with a 3-million barrel, fixed-price purchase, the Department of Energy said on Friday. The announcement caps a year that saw President Biden make unprecedented use of the SPR to help curb soaring domestic energy costs that followed Russia’s invasion of Ukraine. (Read More)

Tech Mahindra to transfer Dynacommerce Holdings to Comviva Netherlands

IT company Tech Mahindra will sell its entire stake in its Netherlands-based subsidiary Dynacommerce Holdings BV to its step-down subsidiary Comviva Netherlands for about ₹58 crore, the company said in a regulatory filing.

The agreement for the deal is expected to be signed during the first week of January 2023 and the transaction is expected to complete around the same time.

“We wish to inform you that the Company has approved the sale of 100 per cent stake in Dynacommerce Holdings BV, a wholly-owned subsidiary of the Company to Comviva Netherlands BV, a step-down subsidiary of the Company,” Tech Mahindra said in the filing. (PTI)

Soybeans near 1-week low on recession fears; wheat firms amid supply concerns

Chicago soybean futures slid 1% on Monday to their lowest levels in almost one week, while corn lost ground as worries over a global economic downturn weighed on prices. Wheat edged higher, recouping losses from the previous session with an escalating conflict between Russia and Ukraine fuelling concerns over supplies. (Read More)

KFin Technologies IPO opens today: GMP, review, other details

The initial public offering (IPO) of KFin Technologies Ltd has opened today and it will remain open for subscribers till 21st December 2022. The technology-driven financial services company aims to raise ₹1,500 crore from its public offer, which is completely OFS (offer for sale) in nature. The financial services company has fixed KFin Technologies IPO price band at ₹347 to ₹366 per equity share.

Meanwhile, shares of KFin Technologies Ltd have become available in grey market ahead of its subscription opening date. According to market observers, shares of KFin Technologies are available at a premium of ₹5 in grey market today. (Read More)

Samara Cap leads race for Birla’s insurance biz

Amazon.com Inc.’s Indian private equity partner Samara Capital has emerged as the frontrunner to buy the insurance broking unit of Aditya Birla Capital Ltd, two people directly aware of the development said on the condition of anonymity.

“Over the past few weeks, Samara Capital and Aditya Birla Capital (the promoter of Aditya Birla Insurance Brokers Ltd) have been negotiating the valuation. For Samara, entering the financial services business is a crucial part of its strategy,” one of the two people cited above said, adding the private equity firm has made an offer for the insurance broker. (Read More)

KKR completes ₹2,474-crore investment in UPL agritech arm

UPL has announced the completion of an investment of ₹2,474 crore by global investment firm KKR for 13.33 per cent stake in Advanta Enterprises, agritech arm of UPL, formerly known as United Phosphorus Ltd.

This is a part of the larger corporate realignment exercise announced in October 2022 to create four distinct business platforms — Global Crop Protection, India Agtech, Global Seeds and Manufacturing and Specialty Chemicals — to unleash growth potential of each of these platforms and unlock the value for UPL shareholders by facilitating ‘fair value recognition’ of each platform, according to a UPL statement shared with stock exchanges on Saturday.

On October 21, UPL announced that ADIA, Brookfield, KKR and TPG will separately invest ₹4,040 crore for minority stakes in UPL’s pure-play business platforms. (ANI)

Poonawalla readies ₹1,000 crore fund for growth-stage firms

Adar Poonawalla, chief executive of Serum Institute of India, has sought regulatory approval to establish the Poonawalla Vision Fund to invest in growth-stage companies from its corpus of ₹1,000 crore contributed by his family, two people with knowledge of the development said.

An application to the Securities and Exchange Board of India (Sebi) was made on 29 September for registration as a category-II alternative investment fund (AIF), one of the two people said, requesting anonymity. “The application is under process.” (Read More)

India’s economic activity looks set to slow as resilience wanes

India’s economy appeared to slow rather than accelerate last month, as high-frequency indicators tracked by Bloomberg signaled worsening business and consumption activity.

Although a dial measuring so-called animal spirits showed activity was steady for a fifth straight month in November, the needle was just one bad data point away from swinging to the left. Exports, a key growth lever in the past year, was among three of eight metrics that performed poorly. The rest were unchanged. (Read More)

Sula Vineyards IPO allotment date likely today. How to check status online

Announcement of share allocation for the initial public offering (IPO) of Sula vineyards Ltd is expected any time today as the tentative Sula Vineyards IPO allotment date is 19th December 2022. Those who have applied for the public issue can do Sula Vineyards IPO status check online y logging in at the BSE website — bseindia.com or at the website of the official registrar of the IPO. The official registrar of Sula Vineyards IPO is KFin Technologies Limited and its official website is karisma.kfintech.com. (Read More)

Wall Street loses ground on Friday, marking 2nd straight weekly loss

Wall Street racked up more losses Friday, as worries mounted that the Federal Reserve and other central banks are willing to bring on a recession if that’s what it takes to crush inflation.

The S&P 500 fell 1.1%, its third straight drop. The Dow Jones Industrial Average dropped 0.8% and the Nasdaq composite lost 1%. The major indexes marked their second straight weekly loss.

The pullback was broad. More than 80% of stocks in the benchmark S&P 500 fell. Technology and healthcare stocks were among the biggest weights on the market. Microsoft fell 1.7% and Pfizer slid 4.1%.

The Fed this week raised its forecast for how high it will ultimately take interest rates and tried to dash some investors’ hopes that rate cuts may happen next year. In Europe, the central bank came off as even more aggressive in many investors’ eyes. (AP)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!

[ad_2]

Source link