The C-suite has transformed over the last century and is entering its next evolution

[ad_1]

The U.S. was drunk with economic prosperity in the 1920s, heady from its World War I victory, and making its debut as a world power. Americans, flush with cash, spent their wealth on newly mass-produced items like radios, refrigerators, and, most importantly, cars.

The automobile was at the center of American life, as evidenced by the 1925 novel The Great Gatsby, which used the car to symbolize America’s newfound affluence and the frenetic pace of life in the Roaring Twenties.

Over 23 million cars were sold that decade, surpassing the decades prior. But the business boom came with structural challenges for companies like General Motors, whose founder, William Durant, struggled to manage sprawling business functions under one cohesive company.

By 1920, Durant had acquired several independent car companies under the GM umbrella, including Buick, Cadillac, and Chevrolet. But he was far better at acquiring companies than leading them.

“Durant was pretty much running the company by himself. It’s a very large company, and it’s got all these individual concerns,” says GM archivist Christo Datini. “He was involved in a lot of decisions that perhaps the person at the top of the pyramid shouldn’t be involved in.”

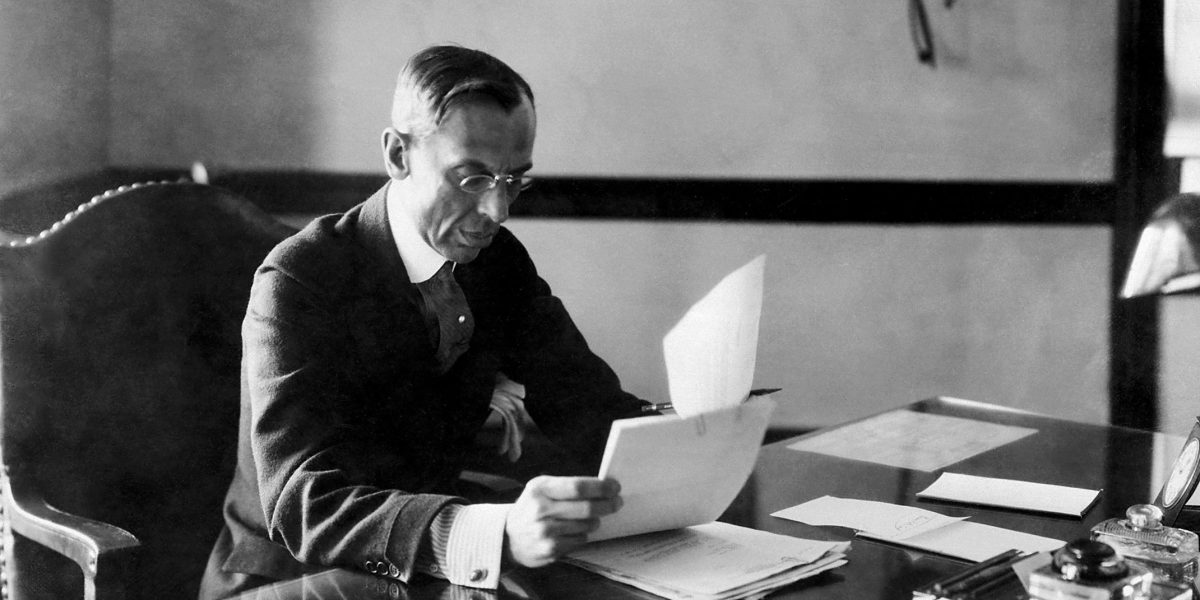

Durant had a contentious relationship with GM’s shareholders and first lost control of the company to bankers in 1910. During his exile, he made his most valuable acquisition: Alfred P. Sloan, whose philanthropic legacy adorns several institutions, including the Sloan Foundation, Massachusetts Institute of Technology’s Sloan School of Management, and the Memorial Sloan Kettering Cancer Center. Sloan would later pioneer the modern-day C-suite, influencing management trends and leadership models for years to come and transforming GM into an automobile powerhouse.

General Motors

Pioneering the modern C-suite

In 1916, Durant’s United Motors Corporation—formed after his first ousting from GM—purchased Hyatt Roller Bearing Company, owned by Sloan. United Motors grew quickly, so much so that GM later acquired it, allowing Durant to return as president and bring Sloan with him.

But Durant’s return to GM was short-lived. He was forced out of the company for a final time in 1920 and replaced by Pierre du Pont, a member of the chemical company dynasty of the same name. All the while, Sloan watched from the sidelines.

“Very early on, [Sloan] realized there needed to be more order and organization to the way things were operating,” Datini says.

GM was decentralized, and its portfolio companies operated independently of one another. “It’s not a tenable situation—or at least Sloan doesn’t think it’s a tenable situation.”

GM’s lack of cohesive leadership inspired Sloan to devise an internal report called the organizational study. Under his plan, the head of each division—say, Oldsmobile, Cadillac, or Chevrolet—would have near-autonomous control over their operations but still need to adhere to cross-company policies and submit to top-down decisions.

It was a massive success. During the Great Depression, when most smaller car companies incurred extensive, if not fatal, losses, GM made a profit each year and grew its market share. Sloan stepped down as president in 1946, and when he retired as chairman ten years later, his stamp on the company was undeniable: The Fortune 500 debuted the previous year, with GM taking first place. It held the top spot on the Fortune 500 consecutively from 1955 through 1974 and ranked first 17 more times after.

General Motors

Shift to functional leadership

Sloan’s brainchild, the corporate hierarchy, is now commonplace across multinational companies, startups, and nonprofits. But it wasn’t until the end of the 20th century that it became ubiquitous. High inflation, relaxed economic regulations, merger mania, technological advancements, and increased global competition characterized the 1980s and 1990s and helped aggrandize what is now known as the C-suite. As companies looked to strengthen operations amid a period of disruption, they shifted from having general managers who made decisions across the entire business to appointing leaders with specific areas of expertise.

Nearly 40 years later, the corporate landscape is changing again, driven once more by a period of financial instability and geopolitical tension. Inflation is rising; COVID-19 has claimed over 1 million lives in the U.S.; the pandemic has exposed the supply chain’s underbelly; and social conflicts have spurred corporate action. In short, today’s executive structure is vastly different from that of the 1920s.

In 2014, Deloitte chief futurist Eamonn Kelly dubbed Sloan’s executive team the C-suite 1.0, shifting to 2.0 in the ‘80s. But the rapid change in technology, social and regulatory demands, and increased globalization have driven the C-suite into its 3.0 era.

Nelson Repenning, professor and associate dean for leadership and special projects at MIT Sloan School of Management, likens today’s C-suite to a car.

“If you think of a modern vehicle compared to 20 years ago, you still have the internal combustion engine. But then you add in the sensors, self-driving elements, safety devices, and connectivity, and there’s probably five times more technology in a car now…It would be the rare engineer who could keep all those pieces,” he says. Similarly, companies found it challenging to coordinate geographies, teams, and areas of proficiency, thus prompting an explosion of C-suite functions over the last five decades.

Chief financial officers

While the chief operating officer has long been considered the CEO’s right hand, chief financial officers are steadily outpacing them. A growing share of companies is combining COO and CFO roles, and the number of S&P 500 COOs promoted to CEOs dropped from 76% in 2000 to 38% in 2020.

In years past, the CFO was oft-dismissed as a “bean counter,” someone who could handle bookkeeping, tax reporting, and other accounting duties. That’s since changed. CFOs now have a global presence, serving as strategic partners on executive decisions, wooing board members and shareholders, and managing complex regulations across geographies.

Twenty-three percent of CFOs occupy a board seat at Fortune 500 companies, and finance heads are increasingly responsible for investor relations. Their growing power has sparked envy among other C-level executives “because chief financial officers are very close to the CEO,” says INSEAD business school professor Jose Alvarez.

But that isn’t to say other C-suite roles haven’t become corporate heavy-hitters in their own right.

Chief human resources officers

CHROs have long been perceived as the indolent narc, overseeing hirings and firings, doling out compensation packages, and handling benefits. But in the pandemic’s wake, the chief human resources officer has morphed into a high-brow position, working with CEOs to drive attraction and retention among a myriad of other talent operations.

Johnny Taylor, CEO of the Society for Human Resource Management, says human capital strategy has existed as a corporate function since the 1990s.

At the time, HR primarily focused on litigation avoidance, compensation, unionization, and civil rights compliance. As companies grew in size and rapid-fire innovation became de rigueur, HR heads began “making the case that we can have all of the money in the world, but if we don’t have the right people with the right skills, and the right roles, then that money will be lost,” he says.

Fast forward to 2022. The culmination of a steadily declining birthrate, high quit rates, and worker unrest has helped create a labor shortage, inciting a war for talent.

“In every board meeting now, a significant amount of time, if not the majority, is spent asking, ‘Do we have the right people? Do you have the right HR person? And do they have a strategic mind?’” Taylor says.

Chief diversity officers

Attractive benefits and hefty compensation packages are enticing, but culture is also critical to attract and hold on to talent. That’s where chief diversity officers come in, and they’re relatively new entrants. Though the role has existed in corporate America in some fashion since just after the civil rights movement, it only became a corporate mainstay in the last 10 to 15 years. Every company now wants a chief diversity officer, says Rosalyn Taylor O’Neale, a diversity consultant and the CDO of Campbell Soup Company from 2008 to 2012.

“Companies want one for the same reason people want a Tesla. It’s like, ‘I’ve heard they’re really wonderful. People have one, I want one,’” says O’Neale. “The challenge is a true chief diversity officer, like a true CFO, understands the role in ways that the CEO doesn’t and can do strategic work.”

The role initially served as a regulatory compliance function. Early practitioners focused on civil rights training, first introduced after the passage of the 1964 Civil Rights Act and the establishment of the Equal Employment Opportunity Commission one year later. Yet O’Neale points out that some companies were early to place diversity heads in strategic business roles. Ted Childs, who served as IBM’s vice president of global workforce diversity from 1967 to 2006, “was what we would call today a chief diversity officer,” she says.

Hiring for chief diversity officers increased by 111% between 2020 and 2021, spurred by racial justice protests. And just over half, 52%, of S&P 500 companies now have a diversity head. As companies work to hit representation targets many set in 2020 and take a more public stance on social issues like abortion, the CDO’s responsibilities are becoming more expansive.

Chief information and technology officers

Cyber security threats, enhanced tech capabilities, and the shift to remote work have made chief information officers the primary stewards of tech strategy and one of the most sought-after advisors to the CEO and board.

CTOs emerged in the late 1980s, a spinoff of research and development lab director roles that were prominent in the 1950s and 1960s. While R&D directors technically held executive titles, they were rarely involved in C-suite strategizing. But by the end of the 20th century, it became apparent that companies needed an expert who could “translate technological capabilities into strategic business decisions,” Roger Smith, then-vice president and group CTO at Titan Systems Corporation, wote in a 2001 white paper.

Similarly, chief information officers came to prominence in the 1980s and became key C-suite stakeholders by the turn of the century. CIOs and CTOs have often existed on two sides of the same coin, with CIOs focused inward and CTOs focused on external products.

But these roles are still being fragmented: 77% of companies now employ chief data or analytics officers, and chief artificial intelligence officers are also becoming a C-suite staple.

Chief marketing officers

Much like the popular tree adage, if a company builds a stellar product, yet no one knows of it, does it exist? Cue the chief marketing officer. Though the advertising industry exploded in the 1950s, CMO titles didn’t appear until the ’90s. When the role originated, marketing heads mainly oversaw advertising and market research, and sales was a separate function. The rise of B2B marketing and e-commerce blurred much of the distinction between the two, creating a need for leaders who understood the combined role and could sell to digital-first consumers who still needed a personal connection before engaging with brands.

Though most CMOs now report to the CEO, some question their purpose on today’s executive team. Repenning argues that chief revenue officers might stand to replace CMOs because marketing now happens on the web.

“What we used to call marketing and sales, thanks to the internet, is an entirely different role,” he says. “I think a revenue officer signals you’re not going to have a Mad Men-era sales force that’ll go out there and shake hands. It’s now all analytics and data about marketing.”

The C-suite 3.0

Like the Hydra from Greek mythology, it seems two new executive roles are created for each longstanding executive role to address corporations’ increasingly complex needs. Of late, companies are appointing chief ethics officers, chief digital officers, chief risk officers, and chief sustainability officers. The number of chief officer titles doubled from five to 10 between the 1980s and the 2000s, and some warn that the C-suite risks bloat with these endless iterations of executive titles.

Alvarez, however, thinks the growth is warranted. While smaller companies can get away with just five C-suite roles, he says, larger companies command more. “Lower than five, you don’t have diversity, and having all the necessary units is difficult. More than 10 is not a team; it’s not even a group. It’s a mess.”

Finding the correct balance between inordinate and insufficient executive supervision can be tricky. But experts say before creating new C-suite roles, companies must ensure they’ll be necessary and permanent fixtures for at least a decade because it’s difficult to demote a senior hire. Nor does it bode well for a company that didn’t appraise its long-term use of an executive function.

“You can promote someone from chief X officer to CEO or a vice president to CXO…But you cannot promote a CXO to a senior vice president or president,” Alvarez says.

Companies seem to be mindful of this. The top three Fortune 500 companies—Walmart, Amazon, and Apple— have an average of five chief officers, including CEOs.

Looking ahead, Mindy Millward, cofounder of the leadership consulting firm Navalent, believes there will be a shift from executives working in silos to more blended roles. For instance, a chief information officer who oversees tech functions as well as data intelligence and insights from areas like marketing, sales, or supply chain operations.

“A lot like what educational institutions have done around people forming their own degrees,” she says.

Some argue in favor of a second-tier C-suite that reports to executive leadership but leaves the CEO unburdened. Such an approach could be useful for companies that want to address contemporary or ephemeral issues. For example, a chief marketing information officer reporting to the CMO and CIO, as further expansion into digital marketing creates overlap between the two functions.

“The more leaders you have, the more complexity the CEO inherits orchestrating the whole,” says Dunigan O’Keeffe, a partner at Bain & Company. “So some of these new roles may not happen at the direct report to the CEO level and could end up being the team underneath that.” He points to a head of data analytics. While the role is “super important,” it probably doesn’t need a C-suite assignment.

The corporate landscape is, in many ways, a reflection of broader societal changes, and rapid transformation is par for the course. Much like how Sloan guided GM through unprecedented change a century ago, today’s agile organizations will have to bring as much forethought and structure to the future C-suite, whether 3.0, 4.0, or 5.0.

[ad_2]

Source link