News, stocks, data and earnings

[ad_1]

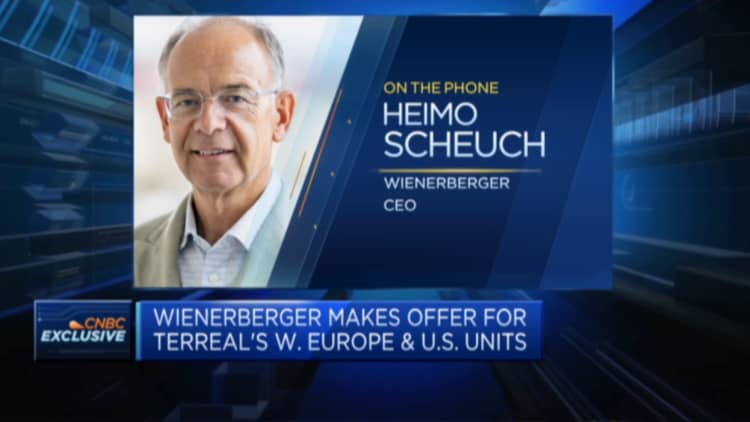

Rising labor costs will add to inflation in Europe, Wienerberger CEO says

Rising labor costs will add to inflation in Europe, according to the CEO of Wienerberger.

Heimo Scheuch, CEO of the building materials group, discussed the company’s deal with Terreal and how it’s coping with inflation on “Squawk Box Europe.”

Deloitte fined £900,000 over building material supplier audits

Deloitte was fined more than £900,000 ($1.1 billion) after failures in its audits of building material supplier SIG for the financial years 2015 and 2016, according to Britain’s accounting watchdog.

The Financial Reporting Council said it imposed a penalty of £1.25 million, which was reduced to £906,250 once Deloitte admitted breaches over its work on the financial statements.

Deloitte was reprimanded and ordered to take action to prevent future breaches.

— Hannah Ward-Glenton

Dollar slips

The dollar fell Tuesday as markets started to wind down ahead of the holiday period.

The U.S. dollar index — which measures the greenback against a basket of currencies — slid 0.44% early Thursday to 103.75, its lowest level in seven days. By 4:20 a.m. ET it was trading around 103.94.

The euro rose 0.47% against the dollar to hit $1.0655, although it pared some gains to trade around $1.0631 by 4:20 a.m. ET.

Germany completes nationalization of Uniper

The German government has completed its takeover of utility company Uniper and now owns 99% of the shares, according to a statement by the economy and finance ministries, Reuters reported.

The move effectively nationalizes the embattled natural gas trader.

The European Commission approved the bailout Wednesday and said the measure “aims at restoring the financial position and liquidity of Uniper in the exceptional situation caused by Russia’s war of aggression against Ukraine and the subsequent disruption of gas deliveries.”

— Hannah Ward-Glenton

UK economy shrinks more than expected in third quarter, ONS says

The U.K. economy shrank more than originally forecast in the third quarter of 2022, according to the Office for National Statistics.

Economic output dropped by 0.3% quarter-on-quarter between July and September, a downward revision of the original 0.2% estimate.

Business investment dropped 2.5% compared to the second quarter of the year, missing expectations of a 0.5% decline.

Slowdowns in manufacturing and construction brought the headline figure down, despite a marginal increase of 0.1% in the services sector.

Household disposable income also fell for the fourth consecutive quarter, and was down 0.5%.

— Hannah Ward-Glenton

Oil prices rise on tight heating oil and jet fuel stocks

Oil prices rose as the U.S. is expecting what its National Weather Service described as “dangerous cold” over the next few days.

Brent crude futures rose 0.52% to $82.63 a barrel, while U.S. marker West Texas Intermediate futures traded up 0.64% at $78.79 a barrel.

On a wider scale, year-end holiday trips is also expected to drive up jet fuel consumption.

– Lee Ying Shan

IMF calls latest Bank of Japan move ‘sensible’

The International Monetary Fund voiced support for the Bank of Japan’s latest decision to widen its band of yield curve control tolerance.

“With uncertainty around the inflation outlook, the Bank of Japan’s adjustment of yield curve control settings is a sensible step including given concerns about bond market functioning,” Ranil Salgado, the mission chief to Japan at the IMF, said.

Salgado added clearer communications around modifications of the central bank’s monetary policy could improve the BOJ’s credibility and “help anchor market expectations,” he said.

– Jihye Lee

CNBC Pro: Investing pro recommends 6 big-cap stocks for another rocky year ahead

Destination Wealth CEO Michael Yoshikami said he expects “tremendous” market volatility in 2023, but investors need not stay on the sidelines.

“Boring. That’s the key,” he said. “The alternative is you pull the money out of the market, you put it in cash till the market comes back. So, this is a way for you to safely still be in the market in more defensive names while still being able to participate in the market if it rises.”

He named six big-cap stocks that investors can take shelter in.

Pro subscribers can read more here.

— Zavier Ong

European markets: Here are the opening calls

European markets are heading for a higher open Thursday, building on gains seen in the previous session.

The U.K.’s FTSE 100 index is expected to open 26 points higher at 5,517, Germany’s DAX 33 points higher at 14,126, France’s CAC up 21 points at 6,599 and Italy’s FTSE MIB up 80 points at 24,163, according to data from IG.

There are no major earnings or data releases.

— Holly Ellyatt

[ad_2]

Source link