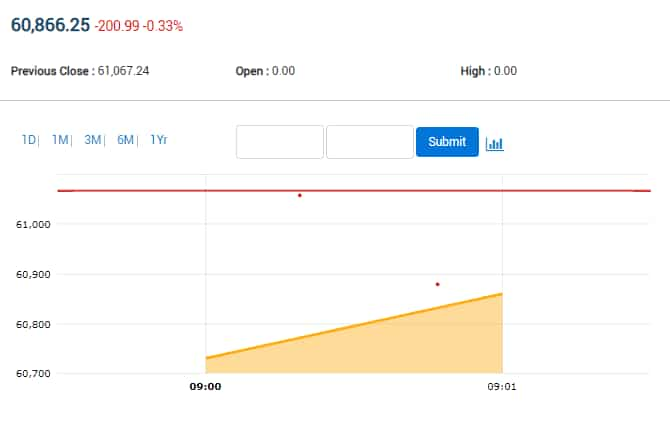

Stock Market LIVE: Sensex sheds 200 pts, Nifty down 50 pts; all sectors in red

[ad_1]

The US market got a boost from a report showing consumer confidence is surprisingly strong, despite inflation squeezing wallets, which will help the economy to stay strong. Rising Covid cases in China will remain a concern for global investors.

No decision yet to stop flights to and from China by Centre: Report

Amid the spike in Covid-19 cases in China, government sources have told ANI news agency that no decision has been taken to stop flight operations “to and from China”. Several opposition leaders and medical experts have demanded the government immediately stop all international flights from China in order to prevent another Covid wave in India.

However, the agency confirmed that so far the government has not taken any such decision yet.

A source told ANI news agency that India does not have a direct flight with China, but only connecting flights. (Read More)

Landmark Cars IPO’s shares listing likely tomorrow. What GMP signals

The Initial Public Offer (IPO) of automobile dealership chain Landmark Cars got subscribed 3.06 times on the last day of subscription on Thursday, helped by huge interest from institutional buyers. The initial share sale received bids for 2,46,45,186 shares against 80,41,805 shares on offer.

As per market observers, Landmark Cars shares have fallen from premium (GMP) and currently available at a discount of ₹15 in the grey market today. The shares of the company are expected to list on stock exchanges tomorrow, i.e., Friday, December 23, 2022. (Read More)

Droneacharya Aerial Innovations IPO: GMP signals strong returns for allottees

Shares of the drone solution company are going to list on Dalal Street soon. As per the tentative schedule of the BSE SME IPO, Droneacharya Aerial Innovations IPO listing date is most likely on 23rd December 2022. The BSE SME IPO (Initial Public Offering) received strong response from retail and other investors and the SME share has remained available above 100 per cent premium in grey market ever since it made its debut in the primary markets. According to market observers, shares of Droneacharya Aerial Innovations Ltd are available at a premium of ₹65 in grey market today. (Read More)

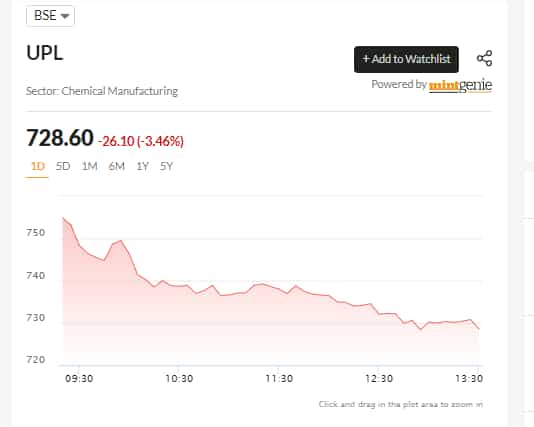

UPL one of the biggest laggards in today’s trade, sheds 3%

View Full Image

Tata Comm to acquire US-based Switch Enterprises for ₹486 cr

Tata Communications will acquire New York-based end-to-end live video production company The Switch Enterprises in an all-cash deal for ₹486 crore, the company said on Thursday.

With both companies coming together, Tata Communications will support The Switch customers with global reach to over 190 countries and territories and The Switch will bring live production capabilities helping organisations to produce high quality immersive content faster and efficiently, Tata Communications said in a statement.

“Tata Communications (Netherlands) B.V., a wholly-owned indirect subsidiary of Tata Communications Limited, will acquire 100 per cent equity stake of Switch Enterprises, LLC, USA and, as part of the transaction, through its wholly-owned subsidiaries,” Tata Communications said. (PTI)

Maruti Suzuki signs 5-year agreement with Kamarajar Port to boost exports

Maruti Suzuki India Limited has signed an agreement with Kamarajar port to export passenger vehicles to global markets, the automaker announced on 22 December. As per the company’s statement, the port will be used to export cars to Africa, Middle East, Latin America, ASEAN, Oceania and SAARC regions.

The company has signed the agreement for a period of 5 years, starting December 2022. (Read More)

SME stock hits record high on bonus shares, stock split announcement; up 135% in a month

Shares of Rhetan TMT Ltd surged as much as 4% hit a record high of ₹469 apiece on the BSE in Thursday’s early trading session after the company announced the issuance of bonus shares along with stock split or sub-division of the equity shares of the company.

“The Board of Directors of the Company in its meeting held on Wednesday has considered the issue of 11 (Eleven) Bonus Shares for every 4 (four) Equity Shares held by the Equity Shareholders of the Company as on ‘Record Date’,” it said in an exchange filing. (Read More)

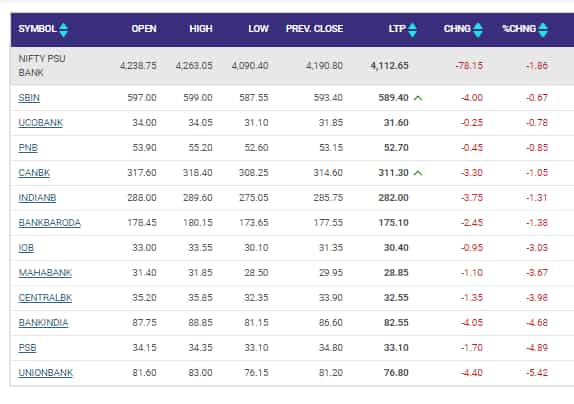

PSU Bank index sheds almost 2% with all stocks trading in red

View Full Image

I-T order against Xiaomi India ‘arbitrary’: Karnataka High Court orders release of FD worth ₹3,700 crore

Karnataka High Court has quashed the income tax department’s block on China-based Xiaomi Corp’s fixed deposits worth ₹3,700 crore. The order, according to Justice SR Krishna Kumar, was arbitrary and revealed a preconceived conclusion without expressing an opinion or a need to seize the property.

“I am of the view that the impugned order passed by the 1st respondent is illegal, arbitrary and contrary to law and the same deserves to be quashed,” said Justice Kumar. (Read More)

Japan’s Nikkei gains first time in a week as BOJ shock eases; Toshiba soars

Japan’s Nikkei index ended higher on Thursday, for the first time in more than a week, as investors bought back shares that had been beaten down by the Bank of Japan’s (BOJ) surprise policy tweak earlier this week.

Automaker shares rebounded strongly after the yen showed signs of stabilizing, and the real estate sector rallied as long-term bond yields also calmed down after steep climbs.

Toshiba ended 4.25% higher and was up as much as 7.61% at one point after local media reported that the company’s preferred bidder, Japan Industrial Partners (JIP), is set to seal a $10.6 billion loan this week.

The Nikkei share average ended the day up 0.46% at 26,507.87, after dipping as low as 26,269.80 in the previous session for the first time since Oct. 13. (Reuters)

SME stock hits record high on bonus shares, stock split announcement; up 135% in a month

Shares of Rhetan TMT Ltd surged as much as 4% hit a record high of ₹469 apiece on the BSE in Thursday’s early trading session after the company announced the issuance of bonus shares along with stock split or sub-division of the equity shares of the company.

“The Board of Directors of the Company in its meeting held on Wednesday has considered the issue of 11 (Eleven) Bonus Shares for every 4 (four) Equity Shares held by the Equity Shareholders of the Company as on ‘Record Date’,” it said in an exchange filing. (Read More)

China’s Imports of Chip-Making Gear Drop to Lowest Since Mid-2020

China’s purchases of machines to make computer chips contracted in November to their lowest in more than two years, hammered by cratering electronics demand and new US export restrictions that are limiting the ability of Chinese firms to buy the most advanced equipment.

Chinese firms imported $2.3 billion worth of machines used in semiconductor manufacturing in November, down by more than 40% from a year earlier to the lowest level since May 2020, according to customs data released Wednesday. Imports from the six major supplying nations including the US, Japan and the Netherlands all fell at a double-digit pace in the month, even before some of those nations agreed to join the US in further limiting shipments of the most advanced gear to China.

Imports of computer chips also fell as makers of semiconductors for smartphone and PCs struggle with plummeting demand for their products less than a year after being unable to produce enough to meet orders. (Bloomberg)

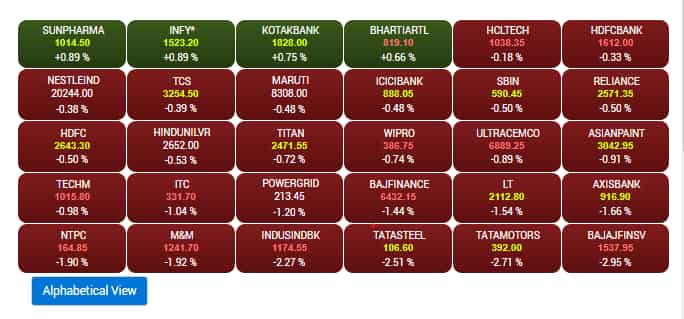

Noon Update: Indices drag as Sensex dips 350 pts and Nifty around 100 points

All sectoral indices are trading in red with IT and Pharma shedding impressive gains made in the morning session

View Full Image

China’s actual Covid numbers may be much higher than what’s reported: WHO

Covid numbers in China may be much more than what the official figures show, as per Mike Ryan, the emergencies director at the World Health Organization (WHO). Unprepared for the sudden cancellation of the zero-Covid lockdown, hospitals scrambled for beds and blood, pharmacies scrambled for medications, and authorities raced to create special clinics. According to experts, China could have more than a million Covid deaths in 2023. (Full Story)

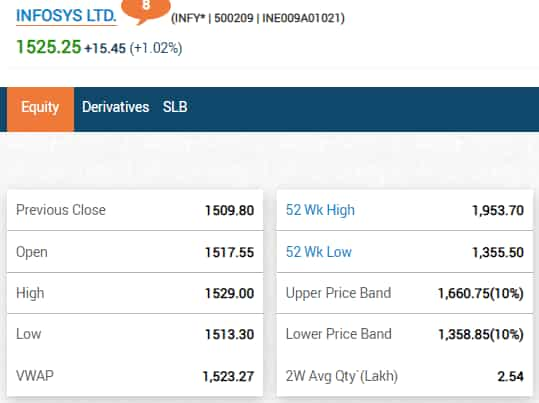

Infosys climbs a per cent in an otherwise dull market

View Full Image

Google links more of CEO Sundar Pichai’s pay to performance

Google-parent Alphabet Inc said on Wednesday it had approved a new equity award for Chief Executive Officer Sundar Pichai that ties more of his pay to performance.

The board recognizes Pichai’s “strong performance” as CEO, the company said, adding that the vesting of a significant portion of the award would depend on Alphabet’s total shareholder return relative to other S&P 100 companies. (Read More)

Yorkshire Water Selects LTIMindtree as a Strategic Transformation Partner

LTIMindtree to transform Yorkshire Water’s core business leveraging SAP S/4HANA and intelligent technologies Mumbai, Maharashtra, India & London, United Kingdom– Business Wire India LTIMindtree, a global technology consulting and digital solutions company, announced today that it has been selected as a transformation partner by Yorkshire Water, a leading UK utilities company, to modernise operations across its clean water, waste water, and asset management businesses. (PTI)

Piramal Realty to invest ₹3500 cr in 2 years; aims to deliver 5,000 flats

Piramal Realty will invest ₹3,500 crore over the next two years in four ongoing housing projects as it aims to deliver a 6 million square feet area to customers, its CEO Gaurav Sawhney said.

Founded in 2012, Piramal Realty is the real estate arm of the business conglomerate Piramal Group. It is one of the leading developers with 15 million square feet of residential and commercial under development in the Mumbai Metropolitan Region (MMR).

In an interview with PTI, Sawhney said the company is developing 13 million square feet in phases across four residential projects in Mulund, Thane, Mahalaxmi and Byculla in the MMR. (PTI)

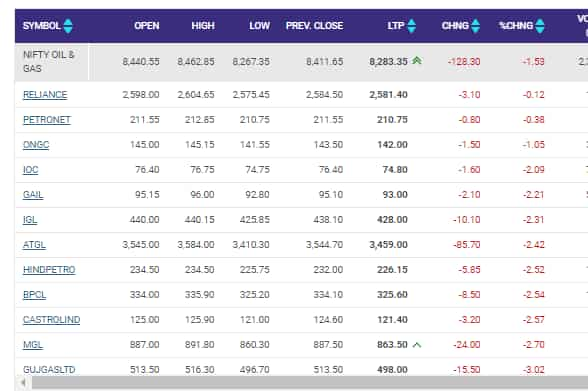

Oil & Gas one of the biggest laggards in today’s session with all stocks trading in red

View Full Image

Why multibagger Venus Pipes’ target price has been raised despite weak market

The Directorate general of trade remedies recommended the imposition of import duty on stainless steel seamless tubes and pipes from China in September 2022. On 20th December 2022, the government imposed anti-dumping duty for 5 years up to 2027.

“The imposition of import duty will increases the cost of hollow pipe procured from China. But, Venus has enough stock in place to meet 2‐3 months of orders. Besides, on account of duty, imports will be costlier and hence, we see room for Venus to increase stainless steel seamless pipes prices by ~Rs20/kg (CMP: Rs420‐450/kg),” said domestic brokerage and research firm Centrum. (Read More)

Dividend paying stock trades ex-bonus today after giving 700% return in 3 years

Shares of Precision Wires India Ltd are one of the stocks in focus today as the small-cap share is trading ex-bonus stock today. The board of directors of the company has fixed 22nd December 2022 as the record date for the issuance of bonus shares. The small-cap company board has already declared bonus shares in a 1:2 ratio, which means one bonus share for every two shares held by the shareholder on the record date for bonus shares.

As expected, the bonus-paying stock has attracted huge buying interest by stock market investors despite weak sentiments in the Indian stock market today. (Read More)

YES SECURITIES: Heavyweight stocks like RIL, Banks and IT Services, look attractive for FY23

· YES SECURITIES deems that the best of FII flows are yet to come; Dollar index has peaked

· The world isn’t facing a 2008 Great Financial Crisis-like situation

· In the US, inflation is also up due to heavy travelling. This is a discretionary expense, which amply shows that internals are not weak

· Expects household consumption to increase by 46% to Rs191trn by FY26, when compared with FY22 levels.

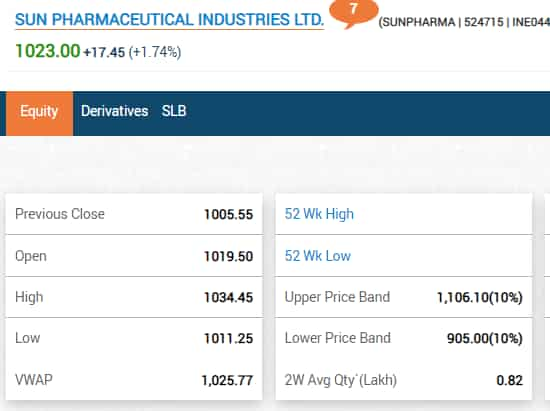

Sun Pharma shines in today’s trading, zooms more than 1.5%

View Full Image

Sula Vineyards shares see positive debut, list at slight premium

Shares of Sula Vineyards Ltd made their market debut on Thursday with the stock listing at ₹361 apiece on the NSE, a premium of more than a per cent as compared to its IPO issue price of ₹357 per share. On the BSE, Sula Vineyards shares started trading at ₹358 apiece.

The initial public offering (IPO) of Sula Vineyards was open from Monday, December 12 till Wednesday, December 14, 2022, which got subscribed 2.33 times by the last day of the offer. The ₹960-crore initial share sale received bids for 4,38,36,912 shares against 1,88,30,372 shares on offer. (Read More)

Mauritius-based FII buys stake in multibagger stock that has risen 300% in 2 yrs

Mauritius-based FII (foreign institutional investor) Maven India Fund has bought a fresh stake in Tirupati Forge Limited. As per the NSE bulk deals, this Mauritius-based foreign investor has bought 6.50 lakh Tirupati Forge shares paying ₹23 apiece. This means the FII has pumped ₹1,49,50,000 into this multibagger stock that has risen to the tune of 300 per cent in the last two years. (Read More)

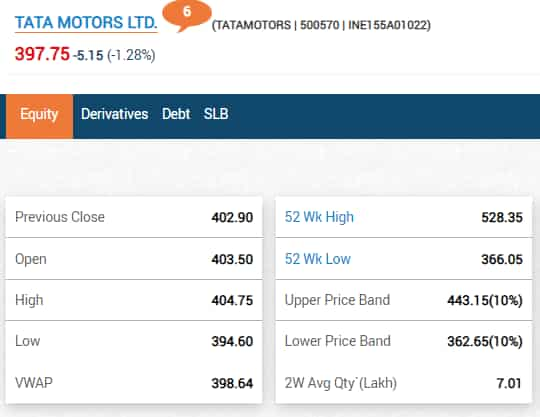

Tata Motors comes under pressure in early trading; sheds 1%

View Full Image

KFin Technologies IPO: GMP, share allotment, listing date details

The initial public offering (IPO) of KFin Technologies was subscribed 2.59 times on the last day of the offer that closed on Wednesday, December 21, 2022. The issue received bids for 6,14,67,520 shares against 2,37,75,215 shares on offer. The three-day initial share sale’s price range was fixed at ₹347-366 a share.

As per market observers, KFin Technologies shares are commanding a premium (GMP) of ₹2 in the grey market today. The shares of the company are expected to list on the stock exchanges BSE and NSE on December 29, 2022. (Read More)

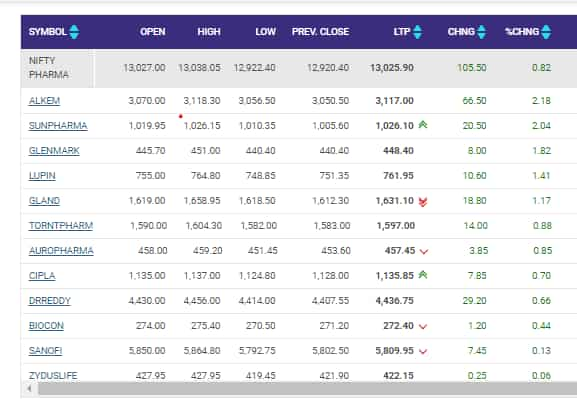

Pharma continues to remain strong for the second day in a row; gains at open with most stocks in green

View Full Image

Continued monetary policy tightening necessary: RBI MPC member Shashanka Bhide

Continued monetary policy tightening is needed to achieve moderation in the inflationary pressures, Reserve Bank of India’s Monetary Policy Committee member Shashanka Bhide said during the latest policy meeting held this month.

“Keeping in view the need to achieve moderation in the inflationary pressures in a sustained manner, continuing with the monetary policy tightening measures is necessary at this stage,” Bhide had said, as per the minutes of the meeting.

With overall domestic growth showing signs of resilience, the adverse global macroeconomic conditions require that the domestic inflation rate is at moderate levels, within the tolerance band of the inflation target on a sustained basis, said Bhide, who is also the honorary senior advisor, National Council of Applied Economic Research, Delhi. (ANI)

Indices open in green with Sensex gaining 300 pts and Nifty 100

View Full Image

Cryptocurrency prices today: Bitcoin, ether flat while dogecoin, Uniswap gain

In cryptocurrencies, Bitcoin price today dropped with the world’s largest and most popular digital token trading almost flat with a negative bias at $16,829. The biggest token is down by three-quarters from its record high of $69,000.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second-largest cryptocurrency, was almost flat at $1,213. Meanwhile, dogecoin price today was trading about a per cent higher at $0.07 whereas Shiba Inu was down at $0.000008. (Read More)

Sensex preopens in the flat zone; Sula Vineyards to debut today

View Full Image

Reliance Securities Stock in Focus for Today: Wipro

STOCK IN FOCUS

Wipro (CMP 390): In view of strong deal wins and attractive valuation, we have a BUY recommendation with a target price of Rs455, valuing the stock at a P/E multiple of 18.5x FY24E earnings.

Intraday Picks

M&M (PREVIOUS CLOSE: 1,266) BUY

For today’s trade, long position can be initiated in the range of Rs1,265-

1,255 for the target of Rs1,294 with a strict stop loss of Rs1,244.

SBILIFE (PREVIOUS CLOSE: 1,234) BUY

For today’s trade, long position can be initiated in the range of Rs1,231-

1,222 for the target of Rs1,275 with a strict stop loss of Rs1,204.

JSWSTEEL (PREVIOUS CLOSE: 743) BUY

For today’s trade, long position can be initiated in the range of Rs737-

732 for the target of Rs758 with a strict stop loss of Rs727.

Ashish Kacholia trims stake in multibagger stock after 100% return in 6 months

‘Big Whale’ of the Indian stock market has booked partial profit in D-Link India shares, which is one of the multibagger stocks in 2022. As per the NSE bulk deal details, Ashish Kacholia has sold out 2.13 lakh D-Link India shares at ₹242.56 apiece. This means the ace investor has fished out ₹5,16,65,280 or ₹5.16 crore from this multibagger stock. After this partial profit booking by Ashish Kacholia in D-Link India Ltd, his shareholding in the company has come down at 2.74 per cent of the total paid-up capital of the company. (Read More)

Stocks to Watch: Sula Vineyards, Reliance, Paytm, Adani Enterprises, Bandhan Bank, Kalpataru Power Transmissions, Zee Entertainment, Max Financial, India Grid, GR Infraprojects, Lupin

NSE continues to keep Indiabulls Housing Finance, Gujarat Narmada Valley Fertilizers & Chemicals, and IRCTC on the list of banned securities under the F&O segment for Thursday trading as they have crossed 95% of the market-wide position limit. (Read More)

Plane with Bankman-Fried departs Bahamas after his extradition approved – Reuters witness

A plane that a source said was carrying Sam Bankman-Fried departed an airport in The Bahamas on Wednesday, according to a Reuters witness, hours after the FTX founder was cleared to return to the United States to face fraud charges over the collapse of the crypto exchange. (Reuters)

India extends halt on futures trade in key farm commodities by a year

India’s market regulator extended the suspension of trading in derivative contracts of key farm commodities by a year as the world’s biggest importer of vegetable oils, and a major producer of wheat and rice, tries to tame food inflation.

The Securities and Exchange Board of India (SEBI) had last year ordered a year-long suspension of futures trading in key farm commodities, a dramatic step since allowing futures trading in 2003.

In a notification issued late on Tuesday, SEBI said the suspension of trading in futures contracts would continue until Dec. 20, 2023, on soybean and its derivatives, crude palm oil, wheat, paddy rice, chickpea, green gram and rapeseed mustard. (Reuters)

Elin Electronics IPO: Check GMP on last day of subscription

The Initial Public Offer (IPO) of electronics manufacturing services company Elin Electronics was subscribed 95% on the second day of subscription on Wednesday. The public issue, with a price range fixed at ₹234-247 a share, will conclude on Thursday, December 22.

As per market observers, Elin Electronics shares are commanding a premium (GMP) of ₹22 in the grey market today. The shares of the company are expected to make its market debut on stock exchanges next week on Friday, December 30, 2022. (Read More)

There will be no more cash burn in business: Paytm CEO Vijay Shekhar Sharma

Going ahead, there will be no more cash burn in the business, Paytm Chief Executive Officer (CEO) Vijay Shekhar Sharma said at the Business Standard BFSI Insight Summit 2022 in Mumbai on Wednesday.

“It has got decided last month that it (cash burn) would no more be continuing,” Sharma said, adding that the digital payments company was far ahead on re-setting its ambition on controlling spends. Earlier in November, Paytm said it would become free cash flow positive in the next 12-18 months. (Read More)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

Vaishali Parekh of Prabhudas Lilladher has recommended two stocks to buy today. Here we list out full details about Vaishali Parekh’s recommendations:

1] Zydus Life: Buy at ₹421, target ₹435, stop loss ₹415; and

2] Aster DM Health: Buy at ₹235, target ₹245, stop loss ₹231. (Read More)

Worldline ePayments India gets RBI’s nod to act as payment aggregator

Digital payments services platform Worldline ePayments India said it has received in-principle approval from the Reserve Bank of India to act as a payment aggregator (PA). The authorisation by the RBI was under the provisions of the Guidelines on Regulation of Payment dated March 17, 2020.

“We’ve been in the Indian market for more than two decades and have built a leadership position. We work with merchants from various segments such as eCommerce, BFSI, Retail, Utilities, Education, Travel and Hospitality for digital payments,” Ramesh Narasimhan, Chief Executive Officer, of Worldline India, said in the statement. (Read More)

Reliance Capital auction: Torrent Group highest bidder at ₹8,600 cr

Torrent Group on Wednesday emerged as the highest bidder for debt-ridden Reliance Capital in the auction conducted as part of its resolution process.

Ahmedabad-based Torrent Group submitted a bid of ₹8,640 crore for acquiring the NBFC firm set up by the Anil Ambani Group, sources said.

Hinduja Group was the second highest bidder, they said, adding Oaktree did not participate in the auction.

The Cosmea Piramal consortium had already pulled out of the bidding process.

The Committee of Creditors (CoC) fixed a floor value of ₹6,500 crore for the auction.

If lenders accept the bid submitted by Torrent Group, which is into pharmaceuticals and power businesses, it will mark its entry into the financial services space. (PTI)

India’s mobile exports on track to quadruple, were worth ₹22,500 crore in 2020-21: DPIIT Secretary

India’s mobile exports so far during the current financial year are worth around ₹50,000 crore and are expected to quadruple in comparison to that in 2020-21, DPIIT Secretary Anurag Jain told ANI.

In pre-Pandemic 2020-21 and in 2021-22, the overall mobile exports, according to him, were worth ₹22,500 and ₹45,000 respectively.

“If you have seen, in the financial year 2020-21, mobile exports from our country were ₹22500, and it has increased to ₹45,000 crore in 2021-22, which means it has directly doubled. So far this year the mobile exports have gone above ₹50,000 crore,” he added.

On Tuesday, the government approved the incentives for two companies — Foxconn India and Padget Electronics — for mobile manufacturing under the production-linked incentive (PLI) scheme. The incentives for the two companies were worth ₹357.17 crore and ₹58.29 crore, respectively. (ANI)

Byju’s, MPL want to exit sponsorship deal with BCCI

Two of the Indian cricket team’s main sponsors, edtech major Byju’s and MPL sports, want to exit from their sponsorship agreements with the BCCI.

In June, Byju’s had extended its jersey sponsorship agreement with the Board until November 2023 for an estimated USD 35 million. Byju’s now wants to terminate its agreement with the BCCI which has asked the company to continue at least until March 2023. (Read More)

Sula Vineyards IPO listing date today. Experts predict ‘flat’ debut of shares

Sula Vineyards IPO listing date has been fixed on 22nd December 2022. As per the information available on the BSE website, Sula Vineyards shares are going to become available for trading from 22nd December 2022 i.e. today on BSE and NSE. The BSE notice went on to add that Sula Vineyards shares listing will take place in a special pre-open session on Thursday morning.

Informing about Sula Vineyards share listing date, BSE notice says, “Trading Members of the Exchange are hereby informed that effective from Thursday, December 22, 2022, the equity shares of Sula Vineyards Limited shall be listed and admitted to dealings on the Exchange in the list of ‘B’ Group of Securities.” However, due to weak stock market sentiments, both experts and the grey market are signalling a flat debut of Sula Vineyards shares on Dalal Street. (Read More)

Mukesh Ambani’s Reliance to acquire German firm Metro AG’s India business

Reliance Industries Ltd will acquire German firm Metro AG’s wholesale operations in India for ₹2,850 crore as the conglomerate run by billionaire Mukesh Ambani seeks to strengthen its dominant position in India’s mammoth retail sector.

Reliance Retail Ventures Limited (‘RRVL’), a subsidiary of Reliance Industries Ltd, signed definitive agreements to acquire 100% equity stake in METRO Cash & Carry India Pvt Ltd. (‘METRO India’) for a total cash consideration of ₹2,850 crore, subject to closing adjustments. (Read More)

Rupee declines by 14 paise to 82.84 against dollar

The rupee declined 14 paise to settle at 82.84 against the US dollar on Wednesday as a massive sell-off in domestic equities and risk aversion in global markets dented investor sentiment.

However, a weak greenback against major rivals overseas and fresh foreign fund inflows supported the domestic unit and capped the losses, forex traders said.

At the interbank forex market, the local unit opened weak at 82.76 against the greenback and witnessed an intra-day high of 82.66 and a low of 82.84.

It finally ended at 82.84, a decline of 14 paise over its previous close of 82.70. (PTI)

Wall Street gained ground on Wednesday, turning higher for the week

Stocks closed broadly higher on Wall Street Wednesday and pushed major indexes into the green for the week, as investors welcomed a report showing consumer confidence is holding up better than expected.

The S&P 500 and Nasdaq composite each rose 1.5%. The Dow Jones Industrial Average gained 1.6% with a lot of help from Nike, which soared after reporting better-than-expected results.

The market got a boost from a report showing consumer confidence is surprisingly strong, despite inflation squeezing wallets. The Conference Board’s consumer confidence index rose to 108.3 in December, up from 101.4 in November. The sharp rebound pushed the index to its highest level since April. Last month’s figure was the lowest since July.

“The news has delivered a kind of a sweet spot for the Federal Reserve,” said Megan Horneman, chief investment officer at Verdence Capital Management. “The consumer is staying relatively resilient.” (AP)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!

[ad_2]

Source link