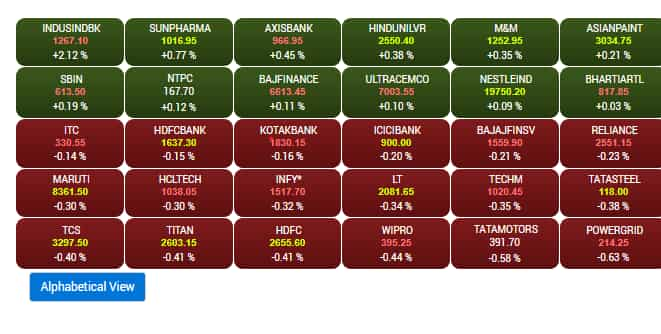

Indices tank as Sensex closes 600 pts lower; all sectors end in red

[ad_1]

Asian indices had a mixed day as Tokyo dragged, while Hong Kong and Shanghai indices welcome new reform measures from the government and gained. The European market was trading higher in the morning session.

Indices tanked a per cent on Wednesday as Sensex and Nifty shed around 600 and 200 points, respectively

Indian indices tumbled a per cent on Wednesday as markets no longer could overlook the mixed global cues. Investors also decided to wait for the minutes from the Fed’s meeting to get cues on the path forward for interest rates.

Sensex sank 635 points to close below 61,000, at 60,657. Nifty also closed below 18,100, at 18,042, a loss of 190 points.

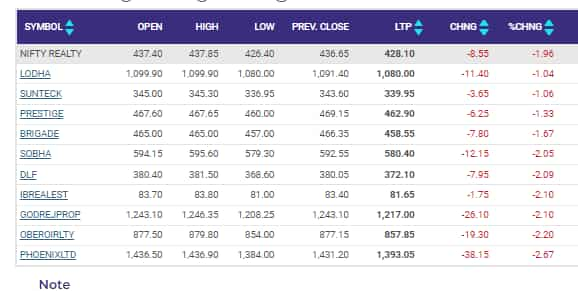

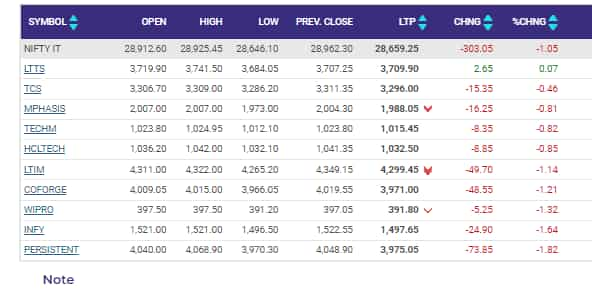

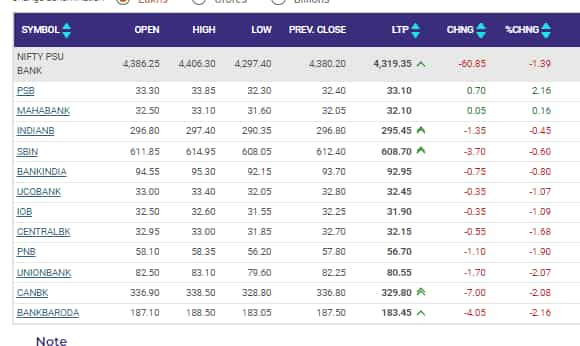

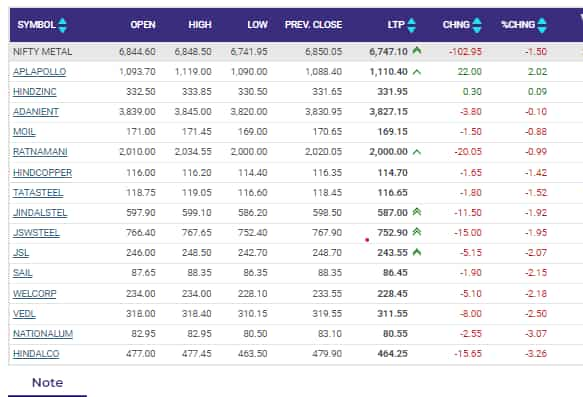

All sectoral indices struggled in today’s session with Metal, Realty, PSU Bank, and Media shedding the most. Pharma and Healthcare were relatively less affected by the negative sentiment.

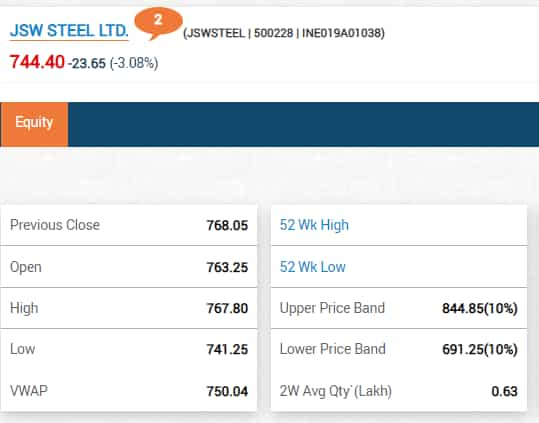

Metal stocks were especially affected by the downward trend as uncertainty over demand recovery in China has forced metal companies to offer retailers discounts, diluting the effect of higher prices, according to reports.

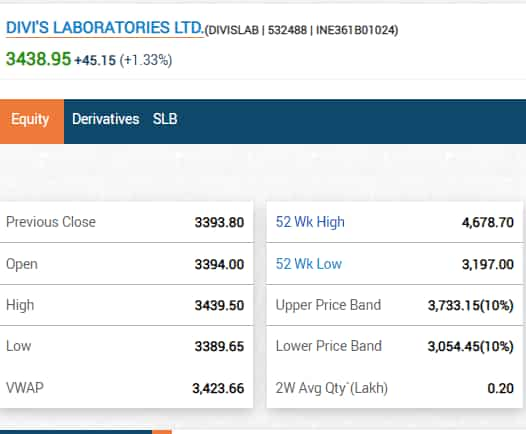

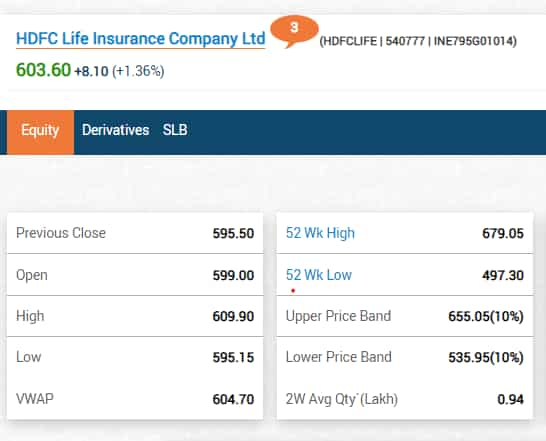

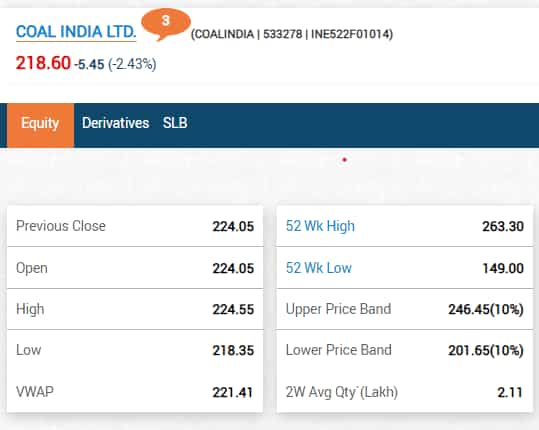

Divi’s Lab gained a per cent in today’s trading followed by Maruti Suzuki and HDFC Life. Amongst laggards, JSW Steel and Hindalco dropped 4%, Coal India more than 3%, and Tata Steel and ONGC more than 2%.

Asian indices had a mixed day with some tracking the overnight Wall Street losses and Chinese indices celebrating the government measures to support struggling industries. Investors also awaited minutes from the U.S. Federal Reserve’s meeting to gauge the path forward for interest rates.

Japan’s Nikkei share average closed at its lowest level in almost 10 months in the first trading session of 2023, tracking Wall Street’s weak finish overnight, while the yen’s strength against the dollar also weighed on sentiment. The Nikkei fell 1.45% to its lowest close since March 15. The broader Topix lost 1.25%.

Hong Kong stocks jumped to their highest since July, while China stocks extended gains, as hopes of a post-COVID recovery, along with supportive policies for real estate and tech companies, boosting the market.

China’s blue-chip CSI 300 index rose 0.13%, while the Shanghai Composite Index gained 0.22%. The Hang Seng index added 3.22% and the Hang Seng China Enterprises Index advanced 3.39%.

European shares extended gains as lower inflation reading from France boosted sentiment, while investors awaited euro zone business activity data and minutes. The pan-European STOXX rose in the morning session. The blue-chip FTSE 100 was tepid as British Prime Minister Rishi Sunak is likely to set out his priorities for 2023.

View Full Image

HDFC Bank advances and deposits grow 19% for December quarter

HDFC Bank’s advances grew 19.5 % (YoY) to ₹15,070 billion as on December 31, 2022 versus ₹12,609 billion as on December 31, 2021; and a QoQ growth on around 1.8 % over ₹14,799 billion as on September 30, 2022.

“As per the Bank’s internal business classification, domestic retail loans grew by around 21.5% over December 31, 2021 and around 5.0% over September 30, 2022; commercial & rural banking loans grew by around 30.0% over December 31, 2021 and around 5.0% over September 30, 2022; and corporate & other wholesale loans grew by around 20.0% over December 31, 2021 and were lower by around 1.0% over September 30, 2022,” the bank informed the exchanges in an update. (Read More)

India approves $2 billion incentive plan for green hydrogen industry

India has approved an incentive plan of 174.9 billion rupees ($2.11 billion) to promote green hydrogen in a bid to cut emissions and become a major exporter in the field, the country’s information minister said on Wednesday.

The move is targeted to help India, one of the world’s biggest greenhouse gas emitters, achieve net-zero carbon emissions by 2070. (Reuters)

Citigroup trims India’s current account deficit forecast to 2.9% of GDP for current fiscal

Investment banking firm Citigroup on Wednesday slashed India’s current account deficit (CAD) forecast for the current fiscal ending March, after services exports rose surprisingly in April-September and oil prices moderated.

According to Citigroup’s India economist Samiran Chakraborty, the shortfall in CAD, the broadest measure of trade in goods and services, will likely be at 2.9% of gross domestic product (GDP) . That is smaller than the 3.3% seen before, and a full percentage point lower than the 3.9% predicted earlier in August. (Read More)

NARCL highest NPV bidder with ₹5,555-cr offer in Srei resolution

The government-backed National Asset Reconstruction Company Ltd has taken lead in taking over two stressed entities of the Srei group as it submitted the “highest net present value bid of ₹5,555 crore” among bidders, an official said on Wednesday.

NARCL’s net present value bid constitutes ₹3,200 crore in cash, a ₹1000-crore jump from the previous plans offered, said the official reported news agency PTI. The bid was submitted in the 10-hour-long “challenge mechanism” conducted by the committee of creditors (CoC) on Tuesday. (Read More)

Motorola inks deal with Jio to enable 5G services on its products in India

Motorola has signed an agreement with Reliance Jio to ensure that its 5G smartphones in India support Jio’s advanced standalone 5G technology.

Standalone 5G is one of the models of deployment of 5G. Network services are provided through an end-to-end core 5G network in contrast to a non-standalone 5G where a 5G radio signal is delivered over an existing 4G infrastructure.

The joint statement said Motorola provides Jios’ True 5G support in all its 5G smartphones, which includes support for 11-13 5G bands, by far the highest in the industry. Additionally, the entire 5G portfolio including affordable 5G smartphones such as moto g62 5G from Motorola come with advanced hardware and software capabilities to deliver the most reliable, fast, secure and comprehensive 5G coverage through the latest technologies.

The joint statement from the two firms said Motorola was the first original equipment manufacturer (OEM) in the world to launch a 5G-capable smartphone and had used its extensive knowledge and understanding of 5G technology to give the most advanced 5G features to Indian consumers across price points. The brand’s 5G smartphone portfolio in India is comprehensive and cuts across multiple smartphone segments, including mass, mid, and premium, according to the statement. (ANI)

Statiq wins REIL contract to supply 253 EV chargers for 4 highway projects

Electric vehicle charging services provider Statiq has recently bagged an order from Rajasthan Electronics & Instruments Ltd. (REIL) to supply 253 fast EV chargers for four key highway projects connecting Agra-Lucknow, Meerut-Gangotri, Chennai-Bellary, and Mangaldai-Wakro. The company has several EV chargers operating in Jaipur, Beawar, Jaisalmer, Udaipur and Jodhpur.

REIL required an assortment of 210 fast chargers of more than 50kW charging capacity and another 43 fast chargers of more than 100kW charging capacity for four-wheelers. (Read More)

Godrej Consumer Products opens mega warehouse in Punjab

Mumbai-based fast-moving consumer goods company Godrej Consumer Products Ltd. (GCPL), on Wednesday announced the opening of its first mega warehouse in Tepla, Punjab, that will connect the company’s factories in North India.

The maker of Cinthol soaps and Godrej Expert hair color said the mega warehouse has already established primary routes across the country and will serve the company’s growing consumer base across key states such as Haryana, Punjab, Uttarakhand, and Himachal Pradesh. (Read More)

JSW Steel leads the Metal index drag in today’s session; sheds 2%

View Full Image

Joyville Shapoorji Housing to invest ₹750 cr on Pune housing project

Business conglomerate Shapoorji Pallonji’s housing platform Joyville will develop a new housing project in Pune worth ₹750 crore, according to the news agency PTI. The company will develop around 1,350 housing units, including duplexes and penthouses, in this new nine-acre project with an estimated sales revenue of over ₹1,000 crore.

“We have acquired about 9-acre land near Hadapsar in Pune to develop a new project,” Joyville Shapoorji Housing Managing Director Sriram Mahadevan told PTI. (Read More)

Muthoot Homefin appoints housing finance veteran Alok Aggarwal as CEO

Muthoot Homefin (India) Limited (MHIL), a wholly owned housing finance subsidiary of Muthoot Finance, has announced the appointment of Alok Aggarwal as its Chief Executive Officer (CEO).

With 20 years of experience under his belt, Alok Aggarwal has served as the MD & CEO at National Trust Housing Finance Limited. Alok has also held leadership roles in organisations like Equitas Bank, Fullerton India HFC, Magma Housing Finance, Lodha Group and Tata Capital.

George Jacob Muthoot, chairman, Muthoot Finance said, “There exists a significant gap between the housing demand and availability of housing finance to the underbanked/marginalised section. …With Alok joining the leadership team, we aim to capitalise on his expertise to spearhead the growth in housing finance business and also contribute significantly towards the Government’s mission of ‘Housing for All’.”

Realty index is the biggest laggard in today’s session, sheds 2% with all stocks trading lower

View Full Image

Axis Bank shares climb to life-time high. Is more steam left?

Continuing its bull trend, Axis Bank share price today ascended to a fresh high of ₹970 apiece on NSE. Axis Bank shares today opened downside but soon attracted buying interest and went on to hit intraday high of ₹970 on NSE, logging near 1 per cent appreciation from its Tuesday close of ₹962.30 on NSE.

According to stock market experts, Axis Bank is in uptrend due to large corporates coming back to Indian systems for credit line. They said that Axis Bank’s focus on tech enabled online lending is also favouring bull run in the banking stock. (Read More)

Byju’s Founder Raising Funds to Buy Back as Much as 15% of Firm

Byju Raveendran, the founder of the world’s most valuable edtech startup Byju’s, is in financing talks to lift his stake in the company to as high as 40%, people familiar with the matter said.

The former teacher is seeking funding to finance the stake repurchases — which could amount to as much as 15% of the firm — by using his shares as collateral, according to the people. Byju’s was valued at $22 billion the last time it raised funds, though the buyback may happen at a lower valuation, the people said, asking not to be named discussing private negotiations.

Founded in 2015 and formally known as Think & Learn Pvt., the Bangalore-headquartered startup shelved plans for a stock-market debut as global markets slumped last year. Raveendran has about a 25% stake and prominent other investors include the Chan Zuckerberg Initiative, Sequoia Capital India, Blackrock Inc. and Silver Lake. (Bloomberg)

Ambuja Cements forms wholly-owned subsidiary – Ambuja Shipping Services

Ambuja Cements on 4 January announced that the company has incorporated a wholly owned subsidiary company in the name of Ambuja Shipping Services Limited (ASSL) on 3 January 2023. The company has been incorporated by Ambuja Cements for the business of operating ships, the company said in regulatory filing. The company has acquired 100% shareholding and the cost of the acquisition is ₹1 crore. (Read More)

Divi’s Laboratories shines in today’s otherwise dull session, adds 1%

View Full Image

Oil falls again after last session’s tumble as economic worries grow

Oil edged lower on Wednesday after slumping in the previous session, weighed down by concerns about weak demand due to the state of the global economy.

Brent futures for March delivery fell 13 cents to $81.97 a barrel, a 0.1% loss, by 0511 GMT. U.S. crude dropped 28 cents, or 0.3%, to $76.65 per barrel.

Both benchmarks plunged more than 4% on Tuesday, with Brent suffering its biggest one-day loss in more than three months.

“Warning signs of global recession, China’s lacklustre recovery with surging COVID-19 cases, renewed strength in the U.S. dollar and dampened risk sentiment are all catalysts keeping oil prices in check overnight,” said Yeap Jun Rong, Market Analyst at IG, in a note. (Reuters)

Worst is Behind for Indian Economy, Bay Capital’s Kodikal Says

The worst may be over for India’s economy with higher consumer spending and positive trends in the manufacturing sector underpinning a recovery, according to Prachi Kodikal, partner at Bay Capital Investment Managers Pvt. Ltd.

“Credit card spends are up, airline traffic numbers are up,” Kodikal told Bloomberg Television’s David Ingles and Yvonne Man on Wednesday.

Read: India Consumer Durables Loans Rise to Record in November

Cash with Indian corporates is at a 14-year high and many are beginning to announce new capex projects, Kodikal said. Capital spending announcements for the private sector “almost doubled last year, which means a lot of companies are getting into the investment cycle,” Kodikal added. (Bloomberg)

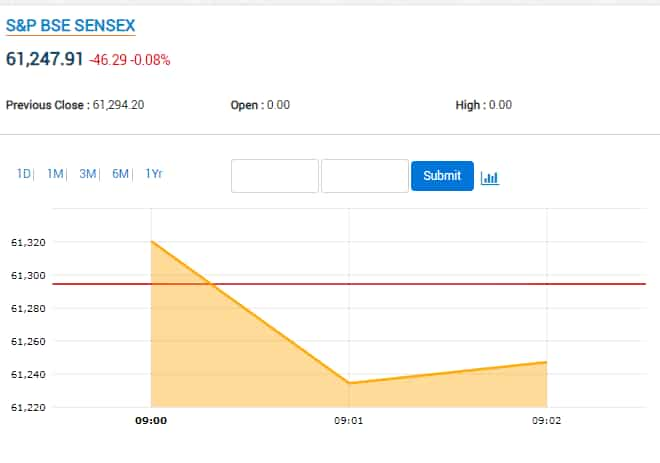

Indices tumble as Sensex sheds 500 pts and Nifty 150 pts in the first half of Wednesday

View Full Image

Cement stock, up 20% in 2 days, clarifies on reports of Adani Group in talks to buy stake

Shares of Orient Cement have rallied more than 20% in the past two trading sessions on the reports of the conglomerate Adani Group in talks to buy promoter stake in the company. The company on Wednesday issued a clarification on the same, saying that it is not privy to any such discussion.

“..on the recent news item which appeared.. captioned “Adani Group In Talks To Buy Promoter Stake In Orient Cement” and its impact on the script price of the company, we wish to state that in terms of Regulation 30 of the SEBI, the company has promptly intimated the Stock Exchanges regarding all events and disclosed all information, that have a bearing on the operations/performance of the company which include all price sensitive information, etc., as and when required.” (Read More)

IT remains another drag in the market as it sheds a per cent with almost all stocks in red

View Full Image

Indian tribunal declines interim stay for Google on Android-related antitrust ruling

An Indian tribunal on Wednesday declined Google’s request for an interim stay on an antitrust ruling that ordered the tech giant to change its approach to its Android platform.

The Competition Commission of India in October fined Alphabet Inc’s Google $161 million for exploiting its dominant position in markets such as online search and through the Android app store, and asked it to change restrictions imposed on smartphone makers related to pre-installing apps. (Reuters)

Fintellix acquired by Private Equity Firm Stellex Capital Management

Fintellix, a leading global provider of data and regulatory compliance solutions, is transitioning to private equity ownership after five years of ownership by publicly traded corporations.

In December 2022, an affiliate of Stellex Capital Management LLC (“Stellex”), a global multi-sector middle market private equity firm, acquired Fintellix, G2, and LCI from TransUnion, forming a tech-enabled risk and compliance platform.

“We are thrilled to partner with Stellex as we look to materially scale Fintellix in the next few years. We will be investing in our people and product innovation and will be bringing even more regional focus to the geographies we operate in to create more value for our customers,” Shailendra Mruthyunjayappa, President and CEO of Fintellix, remarked.

Irina Krasik, Managing Director of Stellex, added, “Over the past decade Fintellix has demonstrated strong growth and established itself as one of the leading providers of regulatory compliance technology. We are excited to support Shailendra and his team in this next phase of Fintellix’s expansion.” (ANI)

Yes Bank shares Q3 update, deposits rise 16% while loans and advances grow 12%

Sharing its business update for the third quarter of the current fiscal (Q3FY23), Yes Bank on Wednesday said that its advances were up at ₹196,826 crore, from ₹176,241 crore, up nearly 12% year-on-year (YoY) and up over 2% from ₹192,235 crore quarter-on-quarter (QoQ).

The bank highlighted that pursuant to the sale of exposures to ARC, Loans & Advances figure as on December 31, 2022 is normalised to make figures comparable with previous periods i.e. an amount of Rs. 5,171 crores has been added representing the net carrying value of the loan portfolio, as on September 30, 2022, sold to JC Flowers Asset Reconstruction Private Limited. (Read More)

HDFC Life stock remains steady amidst a dull market; share jumps a per cent

View Full Image

India’s services PMI growth at 6-month high on robust demand

India’s services industry saw activity increase at the fastest pace in six months during the final month of 2022 amid robust demand, fuelling business optimism despite high costs, a private-sector survey showed. The S&P Global India services purchasing managers’ index (PMI) rose to 58.5 in December from 56.4 in the previous month, confounding expectation in a Reuters poll for a fall to 55.5. (Read More)

PSU Bank index is one of the biggest contributors to the drag in the market; sheds more than a per cent

View Full Image

Radiant Cash Management surges on market debut as shares list at premium over IPO issue price

Shares of Radiant Cash Management Services Ltd made a positive market debut on Wednesday with the stock listing at ₹104 a piece on the NSE, a premium of over 10% as compared to its IPO issue price of ₹94 per share. On the BSE, Radiant Cash Management shares started trading at ₹99 a piece.

The initial public offer (IPO) of Radiant Cash Management Services was subscribed 53% on the last day of subscription on Tuesday, December 27, 2022. The initial share-sale received bids for 1,45,98,150 shares against 2,74,29,925 shares on offer. The issue, which opened on December 23, 2022, had a price band of ₹94 to ₹99 a share for its ₹388-crore public offer. (Read More)

INDIA BONDS-Bond yields dip tracking similar move in U.S. peers, oil prices

Indian government bond yields were lower in early session on Wednesday, tracking a similar move in U.S. yields, as well as oil prices.

The benchmark 10-year yield was at 7.3145% as of 10:00 a.m. IST, after closing at 7.3211% on Tuesday.

A correction in U.S. Treasuries and oil prices led to some bullishness in the market, but any further major downward move in yields was unlikely, a trader with a primary dealership said.

Oil prices tumbled on Tuesday, pressured by weak demand data from China, a gloomy economic outlook and a stronger U.S. dollar.

The benchmark Brent crude contract dropped 4.4%, which is its biggest single-session drop in over three months, and was last trading around $82 per barrel. (Reuters)

Coal India puts a drag on the market as it sheds 2%; one of the biggest laggards in today’s session

View Full Image

Geojit Financial Services on today’s market: India’s outperformance in the economy and markets is set to continue

Dr V K Vijayakumar, chief investment strategist at Geojit Financial Services: A significant recent market trend is the disconnect between US and Indian markets. On many days the Indian market has closed positively after negative closing in US markets. The fundamental reason for this disconnect is the resilience of the Indian economy even in the context of a sharp slowdown in global growth expected this year. This disconnect is likely to continue since data indicates continuation of the Indian economy’s outperformance. Latest data on credit growth from HDFC and IndusInd bank is impressive and augurs well for banking stocks. The data of air travel reaching pre-Covid levels indicates robust economic activity. The decline in US 10-year bond yield to 3.75 % and Brent declining to $82 are positives for India. India’s outperformance in the economy and markets is set to continue, but concerns of US recession and high valuations will put a cap on the upside.

Indian power plants should be compensated for importing coal -regulator

Indian power plants that rely on imported coal should be fully compensated for supplying electricity demand under forced circumstances, the country’s power regulator said on Tuesday.

Power tariffs for imported coal-based plants should cover their costs as well as a “reasonable profit margin,” the Central Electricity Regulatory Commission (CERC) said in an order dated Jan. 3.

The order was related to Tata Power Co Ltd approaching the CERC against the tariff fixed by the power ministry after a forced directive last year to keep operating to avert a power crisis.

The CERC order also said that the tariff fixed by the power ministry was for an interim period.

In May last year, India invoked an emergency clause in the Electricity Act to ask non-operational imported coal-based plants, with a combined capacity of about 17 gigawatts, to resume functioning to meet high electricity demand. (Reuters)

Metal Index comes under pressure in early trading with most stocks in red

View Full Image

Elon Musk cuts Twitter expenses by falling behind on bills

Elon Musk is trying to slash expenses at Twitter as close to zero as possible while his personal wealth shrinks — and this apparently has included falling behind on rent payments at the company’s offices.

Twitter owes $136,260 in overdue rent on its offices on the 30th floor of a building in downtown in San Francisco, according to a lawsuit filed by the building’s landlord last week.

The landlord at 650 California St., which is not Twitter’s main San Francisco headquarters, served a notice to the social media company on Dec. 16 informing it that it would be in default if it didn’t pay within five days. The five days elapsed without payment, according to the lawsuit.

The landlord, Columbia REIT 650 California LLC, is seeking damages totaling the back rent, as well as attorney fees and other expenses. Twitter signed a seven-year lease for the offices in 2017. The monthly rent was $107,526.50 in the first full year and increase gradually to $128,397 per month in the seventh year.

Twitter did not respond to a message for comment. The company no longer has a media relations department. (AP)

Indices open flat on Wednesday with a little tilt towards the red; IndusInd shines

View Full Image

Multibagger IPO: SME stock gives 1600% return to allottees in 7 years

The initial public offering (IPO) of Hi-Tech Pipes Ltd was launched in February 2016 at a price band of ₹50 per equity share. The public issue was proposed for listing on the NSE SME exchange and the initial offer got listed on the proposed exchange on 25th February 2016. Hi-Tech Pipes share price today is ₹858.55 apiece, which means the SME stock has risen to the tune of more than 1600 per cent in the near 7 years of its listing.

Hi-Tech Pipes shares have remained under base building mode for the last month losing nearly 1 per cent in this time. However, in the last six months, Hi-Tech Pipes share price has appreciated from around ₹455 to ₹858 per share level, delivering to the tune of a 90 per cent return to its positional investors. (Read More)

BOJ Ramps Up Bond Buying for a Fourth Day to Cap Rise in Yields

The Bank of Japan announced a fourth day of unscheduled bond buying operations as it tries to reassert its commitment to super-accommodative monetary policy.

The BOJ offered to buy unlimited amounts of two-year notes at a yield of 0.03% and five-year debt at 0.23%. It also offered to purchase a total ¥600 billion ($4.6 billion) of one-to-25-year bonds. The announcement was in addition to its daily offer to buy unlimited quantities of 10-year securities and those linked to futures at 0.5%, the new cap for benchmark yields.

The central bank conducted similar operations between Dec. 28 and 30, buying a total of 2.3 trillion yen of bonds. Wednesday’s purchases came despite a strong start to the year in global bond markets with Treasuries surging and German bunds rallying on signs of slowing inflation. (Bloomberg)

Tata Steel, Hindalco among 4 metal stocks to ‘Buy’; this one to ‘Sell’. Brokerage’s top picks

China’s Central Economic Working Conference, one of the most important events for metals, appears to advocate neutral policy stance for 2023. Post easing cycle in 2020 and tightening in 2021, China is likely to maintain neutral policy bias for second consecutive year (2022 and 2023), as per brokerage and research firm Ambit.

“Chinese credit impulse bottomed at 23-24% late 2021 but should remain at 25-26% through CY23, well short of 32-33% peak in late 2020. China is conscious it needs to stabilize growth and diffuse systematic financial risks, but also cognizant of high leverage in the system, and doesn’t want to open floodgates,” the note stated. (Read More)

Sensex preopens flat on Wednesday; RIL, Vedanta, RailTel in focus in today’s trading

View Full Image

Radiant Cash Management IPO listing date today. Experts predict ‘muted’ debut

Radiant Cash Management IPO listing date has been fixed on 4th January 2022 i.e. today. As per the information available on BSE website, shares of Radiant Cash Management Services Limited shall be listed and admitted to dealings on the exchange in the list of ‘B’ group of securities. Shares of Radiant Cash Management Services Ltd will list on BSE and NSE in a special pre-open session and the retail cash management company has informed Indian exchanges that in respect of shares in demat form, necessary corporate action has been executed to have the lock-in period marked in the depository’s records.

According to stock market experts, valuations of Radiant Cash Management IPO is high and there are various other stocks from the segment available at an attractive valuations. The public issue failed to attract investors as well. Experts said that Radiant Cash Management shares may have a ‘muted’ to ‘discounted’ listing. (Read More)

Stocks to Watch: Radiant Cash Mgt, RIL, Vedanta, L&T, HDFC Ltd, RailTel, Avenue Supermarts, LTIMindtree, IIFL Finance, MCX

Reliance Industries: Reliance Retail Ventures Ltd’s subsidiary on Tuesday said that it will acquire a 50% stake in Gujarat-headquartered Sosyo Hajoori Beverages Private Limited. The FMCG arm, Reliance Consumer Products Limited, is the wholly owned subsidiary of Reliance Retail Ventures Limited has acquired a stake in the Sosyo Hajoori Beverages Pvt Ltd which operated a beverage business under the brand ‘Sosyo’. The existing promoters, Hajoori family, will continue to own the remaining stake in Sosyo Hajoori Beverages Pvt Ltd (SHBPL). (Read More)

ADB, India sign USD 350 million loan to expand metro rail network in Chennai

The Asian Development Bank (ADB) and the government of India have signed a USD 350-million loan to build new lines and improve the connectivity of the metro rail system in Chennai with the city’s existing public transport system.

Rajat Kumar Mishra, Additional Secretary, Department of Economic Affairs, Ministry of Finance, and Nilaya Mitash, Officer-in-Charge, India Resident Mission, ADB, have signed the agreement of the tranche 1 loan for the Chennai Metro Rail Investment Project. The tranche 1 loan is part of the USD 780 million multi-tranche financing facility (MFF) for the project approved by ADB on December 8, 2022, to develop three new metro lines in Chennai.

After signing the loan agreement, Mishra stated that the project would help expand connectivity of Chennai’s central areas to major destinations in the south and west of the city and integrate the metro system with existing bus and feeder services to benefit thousands of daily commuters. (ANI)

Bitcoin, ether, other crypto prices today rise. Check latest rates

Bitcoin price today rose with the world’s largest and most popular digital token trading almost flat with a positive bias at $16,728. The global cryptocurrency market cap today remained below the $1 trillion mark, as it rose slightly in the last 24 hours to $844 billion, as per the data by CoinGecko.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second largest cryptocurrency, gained more than a per cent $1,229. Meanwhile, dogecoin price today was flat at $0.07 whereas Shiba Inu gained marginally at $0.000008. (Read More)

Reliance Securities Stock to Focus for today: Mphasis

STOCK IN FOCUS

Mphasis (CMP 2,004): In view of healthy revenue growth, strong deal pipeline, new order wins and reducing contribution from volatile business of DXC and attractive valuation, we recommend buy rating on Mphasis with 1-Year Target Price of Rs2,330, valuing the stock at 20x of FY24E earnings.

Intraday Picks

WIPRO (PREVIOUS CLOSE: 397) BUY

For today’s trade, long position can be initiated in the range of Rs394-

392 for the target of Rs404 with a strict stop loss of Rs389.

TITAN (PREVIOUS CLOSE: 2,614) BUY

For today’s trade, long position can be initiated in the range of Rs2,587-

2,572 for the target of Rs2,664 with a strict stop loss of Rs2,534.

GRASIM (PREVIOUS CLOSE: 1,717) SELL

For today’s trade, short position can be initiated in the range of Rs1,737-

1,745 for the target of Rs1,677 with a strict stop loss of Rs1,776.

Domestic air passenger traffic touches 1.29 cr to cross pre-COVID level in Dec 2022

The monthly domestic air passenger traffic touched 1.29 crore to cross the pre-COVID level in December 2022, with Civil Aviation Minister Jyotiraditya Scindia terming it as a healthy trend and a good sign for the industry.

In December 2019, the domestic air passenger traffic stood at 1.26 crore.

“2022 sets new record in air passenger movement,” according to a graphic shared by the minister on his Twitter handle on Tuesday.

The traffic reached 1.29 crore in December last year.

There is a healthy trend in domestic passenger movement of late – a good sign for the aviation sector, the minister said in a tweet.

“Monthly domestic passenger numbers in December 2022 crossed the pre-Covid-29 high!” Scindia said. (PTI)

Sah Polymers IPO: GMP on the last day of the subscription

The initial public offer (IPO) of polymer manufacturer Sah Polymers was subscribed 5.35 times on the third day of subscription on Tuesday, January 3, 2023. The initial share sale received bids for 2,99,95,450 shares against 56,10,000 shares on offer. The offer opened for public subscription on Friday, December 30, 2022, and will conclude on Wednesday, January 4, 2023.

According to market observers, Sah Polymers shares are commanding a premium of ₹5 in the grey market today. The company’s shares are expected to list on leading stock exchanges BSE and NSE next week on Thursday, January 12, 2023. (Read More)

NCLAT to hear Google’s appeal against CCI’s Rs1,337 crore penalty order today

The National Company Law Appellate Tribunal (NCLAT) will on Wednesday hear an appeal filed by Google LLC. contesting Competition Commission of India’s (CCI) order imposing a fine of ₹1337 crore on the tech company for alleged violations in the android mobile ecosystem.

NCLAT’s principal bench in the national capital comprising Justice Rakesh Kumar and technical member Alok Srivastava will hear the appeal, NCLAT’s schedule for Wednesday showed. The company is represented by counsels Toshit Shandilya and Ravisekhar Nair. (Read More)

Rupee falls 8 paise to close at 82.86 against US dollar

The rupee pared initial gains and settled 8 paise lower at 82.86 (provisional) against the US dollar on Tuesday, weighed by a strong greenback overseas and sustained foreign fund outflows.

At the interbank foreign exchange market, the rupee opened on a positive note at 82.69 against the greenback, but pared the gains and fell to an intra-day low of 82.92.

The domestic currency finally settled at 82.86, down 8 paise over its previous close of 82.78.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 1 per cent higher at 104.55.

Global oil benchmark Brent crude futures rose 0.02 per cent to USD 85.93 per barrel. (PTI)

Reliance Consumer to acquire 50 pc equity stake in Sosyo Hajoori Beverages

Reliance Consumer Products Limited (RCPL), the FMCG arm and a wholly-owned subsidiary of Reliance Retail Ventures Limited. (RRVL), on Tuesday announced it will acquire a 50 per cent equity stake in Gujarat-headquartered Sosyo Hajoori Beverages Private Limited (SHBPL), which owns and operates a beverage business under the flagship brand ‘Sosyo’.

The existing promoters, the Hajoori family, will continue to own the remaining stake in SHBPL.

Sosyo is a heritage Indian brand with around 100 years of legacy in carbonated soft drinks (CSD) and juices. Established in 1923 by Abbas Abdulrahim Hajoori, the company is one of the leading players in the domestic soft drinks market. (ANI)

RailTel to monetise Wi-Fi project covering over 6,100 railway stations

RailTel on 3 January has announced that it has tied up with a technology firm in a bid to monetise its Wi-Fi project at more than 6,100 railway stations across India. RailTel which is a PSU under the Ministry of Railways, signed a five-year contract with a consortium led by 3i Infotech Ltd, a global information technology company based at Mumbai, a company statement said.

The other members of the consortium are Forensics Intelligence Surveillance and Security Technologies Private Limited (FISST) and Yellow Inc. (Read More)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

Vaishali Parekh of Prabhudas Lilladher has recommended two day trading stocks to buy today, here we list out full details in regard to those two scrips:

1] Indian Hotels: Buy at ₹320, target ₹335, stop loss ₹315; and

2] Axis Bank: Buy at ₹962, target ₹980, stop loss ₹948. (Read More)

Steep discount in domestic spot gold to bank rate raises eyebrows

Spot gold prices in the domestic market have been trading at a steep discount to the metal’s bank rate for an extended period, a departure from the typical premium it trades at, especially during the wedding season.

Spot gold was trading at an $18-25/ounce (approximately 31g) discount, against a typical premium of $1, for a record 40 days now because of a supply-demand mismatch driven by a sharp jump in price, rise in circulation of recycled gold, a trade pact with the UAE that facilitates import of the metal at lower duty, and suspected leakages, traders said. (Read More)

Wall Street starts the year with a dip; Apple, Tesla shares drag

Wall Street’s main indexes closed lower on the first trading day of 2023 with big drags from Tesla and Apple, while investors worried about the Federal Reserve’s interest-rate hiking path as they awaited minutes from its December meeting.

Shares in electric vehicle maker Tesla Inc hit their lowest level since August 2020 and put pressure on the consumer discretionary sector after missing Wall Street estimates for quarterly deliveries.

Apple Inc shares sank, with the iPhone maker hitting its lowest level since June 2021, after a report from Nikkei Asia pointed to weaker demand. In addition, an analyst downgraded their rating of the stock due to production cuts in COVID-19-hit China.

According to preliminary data, the S&P 500 lost 15.43 points, or 0.40%, to end at 3,824.07 points, while the Nasdaq Composite lost 78.21 points, or 0.75%, to 10,388.28. The Dow Jones Industrial Average fell 12.33 points, or 0.04%, to 33,134.92. (Reuters)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!

[ad_2]

Source link