How to Create Rules in QuickBooks Desktop

This automation enhances the visibility and control of financial inflows and outflows, contributing to improved cash flow monitoring and planning. The rule for splitting transactions into multiple categories is a commonly utilized feature in QuickBooks Desktop, enabling the segmentation of transactions based on diverse criteria or attributes. This rule facilitates detailed categorization and allocation of transaction amounts across multiple accounting categories. By navigating to the Banking menu and selecting the “Banking” section, users can access the “Rules” tab. Once there, they can view, add, edit, or delete rules to streamline transaction processing.

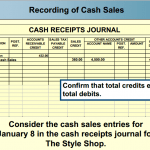

Set up bank rules to categorize online banking transactions in QuickBooks Online

The precision and consistency brought by rule-based operations result in more accurate financial records, enabling businesses to make informed decisions based on reliable data. Editing rules in QuickBooks Online involves modifying the automated instructions that govern transaction categorization and management, allowing users to refine and customize their financial data organization. By automating repetitive tasks such as expense categorization and vendor payments, rules ensure accuracy and consistency in financial data entry.

Use Clear and Specific Conditions

Adherence to rules creates a standardized approach, facilitating easier monitoring and analysis of financial performance over time. This ultimately supports informed decision-making and ensures compliance with regulatory requirements. By automating the normal balance: definition and meaning categorization and processing of transactions, rules can significantly reduce the time spent on manual data entry and reconciliation tasks.

- Adapting transaction management involves customizing the criteria for how transactions are classified, providing a more tailored approach to organizing and analyzing financial data within the QuickBooks Online platform.

- The ability to automate categorization, classification, and handling of transactions can significantly enhance efficiency and accuracy in your bookkeeping.

- Clear and concise names help in categorizing and managing transactions effectively, reducing the risk of confusion or errors.

- They enable businesses to automate repetitive tasks, such as categorizing transactions, thereby saving valuable time for other critical activities.

- When naming rules in QuickBooks Desktop, it is advisable to maintain simplicity and clarity, ensuring that the names accurately reflect the purpose and criteria of the rule.

So, let’s embark on this journey to unravel the power of rules in QuickBooks Desktop and unlock their potential to revolutionize your accounting practices. The ability to generate class or location-specific reports enables more accurate business reporting and analysis, supporting informed decision-making and strategic planning. They scan downloaded bank items for certain criteria you specify, and then assign particular payees, categories, classes, locations, and more to them. If you have created a backup copy of your company file before entering/adding the downloaded transactions, you can restore a backup company file and start over. If everything looks good, select Add to move the transactions directly into an account in QuickBooks. These rules cater to diverse transaction scenarios and business requirements, offering automation for various financial tasks.

Staying abreast of rule optimization allows businesses to harness the full potential of the software, resulting in enhanced efficiency and productivity. Employing clear naming conventions and descriptive explanations for each rule can streamline the identification and management of transaction categorization, ultimately saving time and reducing errors. Implementing best practices when creating rules in QuickBooks Desktop is essential for optimizing the effectiveness and efficiency of automated transaction management. By following established guidelines, users can ensure that their rules are what are dividends how do they work structured for maximum accuracy and consistency in financial record-keeping. By creating customized rules, users can tailor the system to categorize and handle transactions according to specific parameters and conditions.

Create an Advanced rule from a transaction

They enable businesses to automate repetitive tasks, such as categorizing transactions, thereby saving valuable time for other critical activities. By ensuring that transactions are accurately categorized, rules contribute to improved financial accuracy, which is essential for making informed business decisions. Rules in QuickBooks Desktop are predefined instructions that dictate how specific transactions should be categorized, managed, and recorded within the accounting system. These rules automate the process of sorting and organizing transactions based on predetermined criteria, providing efficiency and consistency in financial record-keeping. Changing rules in QuickBooks Online entails making adjustments to the automated instructions that dictate transaction categorization and management, allowing users to adapt their financial data organization. This functionality is extremely useful for businesses wanting to streamline their accounting processes and ensure accuracy in recording financial transactions.

Correct transactions that were already renamed and added with the incorrect name?

You can create rules to categorize transactions for things you often spend debit memorandum memo definition money on, like supplies or business expenses. By efficiently managing and removing unnecessary rules, users can enhance the accuracy and efficiency of their transaction recording and categorization in QuickBooks Online. In our last blog, we covered how to tackle shared transactions in QBO; this month, we’re covering banking rules. When used properly, rules can automate the categorization of the majority of your recurring expense transactions, transfers, and deposits, saving you what could be a few hours, or even months.

By enforcing predefined criteria and actions, rules in QuickBooks Desktop contribute to maintaining consistency and accuracy in bookkeeping processes. The automated categorization and handling of transactions ensure uniformity and precision in financial record-keeping. It streamlines the task of ensuring that payments are executed on time, reducing the risk of missing important deadlines. By automating these transactions, businesses can avoid manual errors and free up valuable time and resources for more strategic financial activities.