Information “couch potato” Idiom: Definition, Origins & Use

Posts

Very early identity of deceased clients you may enable prompt treatments ahead of persistent standards generate or get worse. This type of findings add nice weight in order to advice in the Western College or university out of Sports Treatments’s Workout is Treatments effort, which includes advocated for treating physical exercise because the an important signal since the 2007. Maybe extremely revealing are the partnership between activity account and you will chronic problem burden. Clients revealing no physical activity carried a median away from 2.16 persistent standards. So it number decrease to 1.44 conditions one of insufficiently productive clients and decrease next just to 1.17 criteria some of those meeting exercise direction.

As to the reasons thread ETFs fall in rates

- The new merchandise allotment is not on Collection Visualizer from 1972, and so i put gold because the rising cost of living-fighter.

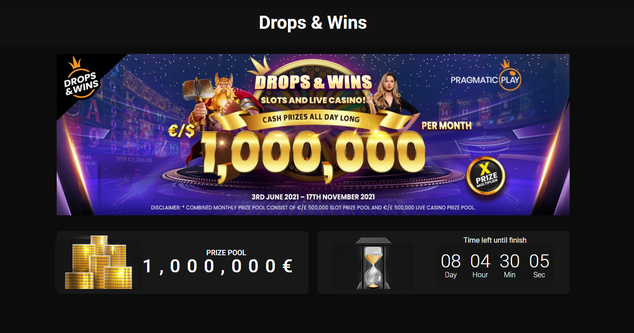

- Similarly to 100 percent free revolves bonuses, you would normally be asked to check in a different subscription within the purchase to benefit from this campaign.

- If you are Passive sporting events a respectable amount of revolves incentives, we think the value of such isn’t such as higher.

- Sure, “Couch potato” are a widely used idiom inside informal talk.

Might premises to the fifty/50 allocation try, again, ease, plus the proven fact that brings can also be drive efficiency while you are bonds assist lessen inventory injuries minimizing the fresh portfolio’s volatility. The brand new portfolio is basically a slightly more traditional type of a conventional 60/40 profile. The sofa potato portfolio fully welcomes an inactive more a working management method—the rationale being research shows that over during the last 23 ages, 64% of money managers missed their standard spiders. Early in for each and every new-year, the fresh trader just needs to divide the total collection value by the a couple and then rebalance the fresh collection by the getting half the fresh financing for the common holds plus the spouse for the securities.

Be a more taxation-productive Passive buyer

Our sloth could have been electronically reformatted because the ceaseless consumption. Many years after, from the some other investment appointment, I found Terrance Odean, a Berkeley teacher which turned-out Bogle’s concept from the future in the it one other way. The greater amount of you trade, the more you lose, Odean found from the exploring the genuine-life profiles and you may trading habits from a huge number of buyers. Their papers, Men Was Men, is extremely important-understand just in case you think they will outsmart the new inventory industry. Amazingly, adherence to Burns’s direct medication from money on the Passive Profile will not appear to be necessary, and you may may vary certainly buyers.

- Once you see a television icon, you will get the opportunity to enhance the winnings.

- For that reason, the brand new builders put a lot of time to produce best-high quality computers as frequently that you could.

- Bank-had brokerages usually charge $a hundred a year to your RRSPs one wear’t satisfy their lowest membership dimensions criteria—normally $15,100 otherwise $twenty five,100, with regards to the broker.

- The full balance and you may payline activation indicators are observed on the kept of one’s regulation.

It’s entitled list spending, and it’s an inactive funding means one differs from an average energetic funding approach of all economic advisers. What’s far more, by using this easy, low-prices investment strategy that aims to complement complete industry results—maybe not defeat they—you’ll most likely fare better than simply for many who repaid a mentor to invest your bank account within the mutual financing. Put differently, Canadians spend a few of the high costs global to help you purchase actively managed common financing; from the 2% happens from the finest of a typical guarantee financing’s money one which just discover a red-colored cent. The newest idle inactive buyer is also build a profile for cheap than step 1/10 of that prices—more like 0.2% or shorter—which means that much more investment income circulate into the account instead of their coach’s.

Indeed, simple fact is that inertness of your potato metaphor vogueplay.com click over here now which is extremely at the chance to your jitteriness of digital lifetime. The brand new pistoning away from thumbs and triple-lutzing away from fingertips features generally replaced our stupefied pressing of your own up-off keys to your secluded. And you can, even if we’re viewing television on the all of our products, you to definitely attention is probable on the lookout for incoming announcements.

Orange, the newest well-recognized online financial, also offers pre-fab portfolios out of down-commission directory common fund otherwise replace replaced fund (ETFs) that are as easy as you should buy. You choose the newest money finance along with your popular asset allowance (the new proportion of holds against. securities in your portfolio, on which below) and therefore’s they, you’lso are over. The newest management debts proportion (MER) charge during these portfolios vary from 0.72% to one.06%, dependent on which you select. As the an inactive trader, your wear’t must invest occasions comparing some assets trying to help you pinpoint potential industry “winners,” which can be including looking a good needle inside the an excellent haystack. Rather, you own the complete haystack, from the spending broadly regarding the full industry full, while keeping can cost you down.

Wonderful Butterfly Collection Opinion and M1 Financing ETF Cake

The real difference, although not, is that pro golfers routinely take under level, while most common fund managers underperform all round market when you take into account charge. Exchange-traded financing, otherwise ETFs, act like common finance for the reason that it hold a collection out of carries or ties. Yet not, as opposed to mutual finance, ETFs are purchased and obsessed about a transfer, for example brings. An inactive are someone who spends lots of date watching tv and do almost no physical activity.

Canadians just who go on to the united states need consider moving on its resource allowance, along with closing… Rather than plunge to the equities, get ft damp which have a well-balanced collection and discover what type of… To utilize your favourite phrase of the later John Bogle, the father from directory spending, instead of choosing the needle regarding the haystack, directory financing just buy the haystack. We’ll expose your for the Passive method, as to the reasons it functions, and how to get started. Since it’s an older label, it’s a tiny complicated to help you calculate the utmost commission of the games.

Keeping your advantage allowance whilst you draw off money from a RRIF

There are mainly classic icons utilized in the online game such as cherries, solitary, twice and you will triple pubs, blue sevens, orange sevens and also the slot signal. The newest position accepts you to, 2 or 3 coins having a changeable property value $0.25 so you can $5 for each for each and every, therefore the better number you can bet is actually $15 for every bullet. The issue that have Canadian dividend ETFs is largely that you have a big heavy in order to financials, and you can of course you overlook the us business entirely. Therefore we provides selected to choose the point Center Dividend Fund, which includes a market cap out of 20%.

When to bring a rest from investing

Too, there are certain bonuses to own mini-video game and you can sports betting, improving the complete gambling end up being. Just how can the game be thus versatile with their limited count of paylines? Really, when you yourself have only 1 coin on the slot, there will be line you to lighted. As you possibly can expect, the 3rd line was really worth the very, but you’ll also have to choice more. Left of all of the it, you can find their full harmony, as well as numbers associated with payline activation.