AMD’s stock falls on in-line projection after the company says it will sell $4 billion in AI processors this year

Advanced Micro Devices (AMD) reported its first-quarter earnings and sales, slightly surpassing Wall Street’s expectations but met with a 7% drop in extended trading, painting a mixed picture for investors.

Here’s a rundown of how they fared against consensus expectations:

– Earnings per share: AMD posted 62 cents adjusted, just a notch above the 61 cents anticipated.

– Revenue: Coming in at $5.47 billion, slightly edging out the expected $5.46 billion.

Looking ahead, AMD forecasts around $5.7 billion in sales for the current quarter, aligning with Wall Street estimates and signaling a modest 6% annual growth.

Despite the positive outlook and growth in AI chip sales, AMD’s shares took a hit. The chipmaker highlighted its Data Center segment, boasting an 80% year-over-year growth to $2.3 billion, fueled by strong sales of its MI300 series AI chips, positioned as competitors to Nvidia’s GPUs. Notably, major players like Microsoft, Meta, and Oracle have embraced AMD’s MI300X, with over $1 billion in sales since its Q4 2023 launch.

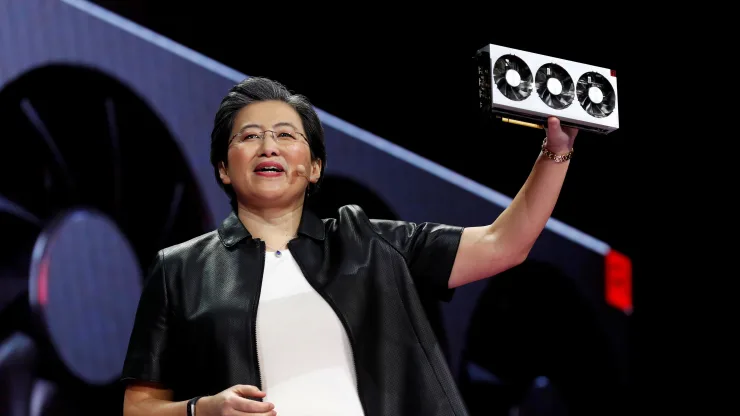

CEO Lisa Su emphasized AMD’s commitment to advancing AI technology, hinting at new chip developments and successors to the current generation. With an eye on expanding AI chip sales to $4 billion in 2024, AMD faces stiff competition from Nvidia, which reported $18.4 billion in AI chip sales for its data center segment alone in the last quarter.

In the CPU market, AMD appears to be gaining ground, potentially siphoning market share from Intel. Su highlighted improving demand for AMD’s CPUs, buoyed by the AI server boom.

However, AMD’s gaming segment stumbled, dropping 48% year over year to $922 million, attributed to lower chip sales for consoles and PCs. The company’s gaming sales fell short of expectations, reflecting a slowdown in the gaming hardware market.

On a brighter note, AMD’s client segment revenue, driven by PC processors, saw a robust 85% annual increase, signaling a rebound from last year’s PC slump. AMD’s processors, capable of running AI programs locally, position the company to tap into the emerging market for “AI PCs.”

Meanwhile, the embedded segment, stemming from the Xilinx acquisition, reported declining sales, falling short of Wall Street’s expectations.

Overall, AMD’s performance underscores its strides in the AI chip market and CPU segment, offset by challenges in gaming and the embedded segment, painting a nuanced picture for investors amidst evolving market dynamics.